Helping Albertans find relief

Let’s put debt behind you, together

Relief is just a conversation away.

You’re not starting over, you’re moving forward.

Our services

Find the right option for you

Every financial situation is unique. That’s why we offer custom options to help you eliminate debt and move forward:

Consumer Proposals

Consumer Proposals

Reduce unsecured debt by up to 80% and avoid bankruptcy with a structured alternative to consolidation: one affordable monthly payment.

division i Proposals

division i Proposals

A solution for larger debts, helping businesses and individuals restructure what they owe and avoid bankruptcy.

Bankruptcy support

Bankruptcy support

When it’s the right move, we make the process clear & manageable.

credit rebuilding help

credit rebuilding help

Included with consumer proposals and bankruptcy:

tools, resources, and in-house counselling on money management, budgeting, and credit rebuilding – all to help you bounce back stronger.

People trust BNA

Local and licensed to help you start fresh

We’re more than a debt relief firm, we’re a team of Licensed Insolvency Trustees serving communities across Alberta. We’ve helped thousands of Albertans stop collection calls, reduce what they owe, and build a plan that actually works. With no judgment and clear guidance, we’ll help you take back control and move forward with confidence.

What our clients say

You’re not alone, we can help

Thousands of Albertans have left debt behind with BNA. Here’s what some of them have to say:

If you are in a position where you need to find a solution out of debt, reach out to BNA for more information. There is no commitment to find out what options are available. I was embarrassed and uncomfortable to share the details of my experience but Sammie immediately put me at ease. She is compassionate, knowledgeable, flexible and an amazing problem solver. She covered all options available to me at my convenience, she passed no judgment, and I felt no pressure to commit. Together we settled on an option that worked best for me. It is never a winning situation to be in a position where you need to dig yourself out of a hole you created but I can finally see a light at the end of the tunnel, thanks to the team at BNA.

You walk in anxious and heavy, that awful burning in the pit of your stomach that comes with debt; feelings of shame, uselessness, irresponsibility. But then you talk to a representative like Simmie, and the weight of the burden begins to melt away. She’s there for you, she talks you through many options, she answers each and every one of your questions with clarity and compassion. Not only does she want to help, she’s trained and licensed to do so. There is work involved for you in this collaborative process, papers and numbers and lists but in the end you are presented with a very feasible, simple plan that allows you to breathe, to engage with your life and your finances in a measured way. I cannot thank Simmie and BNS enough for their empathy, quick turnaround, and straightforward processes.

Unfortunately ran into a sticky financial situation and was referred to BNA Debt Solutions through a debt counselling service. Have had a few meetings and they were always very helpful, kind and understanding. They made my consumer proposal very easy to understand and walked me through it all to ensure I was comfortable with the documents before we took any action. If you’re stressing out about financials, there is help available and I wish I would have reached out earlier. BNA is a great option!

I’ve got myself in very ugly financial situation. It was so stressful that I thought my life is over. It had very big impact on my mental and physical health. When I found out about BNA and their business it was just thin hope that maybe I would find some help. My first appointment was with Simmie Pandher in the office of BNA. After I presented my situation and my worries, Simmie has shown an enthusiastic interest to understand , assist and help me. She sounds like an angel when she said to me that I came to right place where they will find right solution for me. She told me that all my worries ,sleepless night and other concerns will be over. Now because of professional dedication and knowledge of Simmie and Andy Wong and their all team I am back to life again. THANK YOU!

Bad things happen to good people, especially in times of economic and employment uncertainty.

From the very beginning, from my first phone call, BNA Solutions has treated me with respect, empathy and complete professionalism.

The staff were very thorough, knowledgeable and prompt with all my interactions. All options were explained to me and I felt there was hope rather than darkness and despair.

Have used BNA Debt Solutions twice. Once for credit card debt and another regarding a business failure. Both times very empathetic to my situation. I felt I had someone in my corner when it came to dealing with institutions that were aggressive and not empathetic to our situation. Would recommend them infact I have sent three other individuals that had financial challenges and they were grateful that I recommended such a strong team of advocates for their situations.

what to expect

A clear path to a fresh start

Taking the first step can feel overwhelming, but the process is simple. Here are the four steps we use to guide you from the first conversation to lasting relief.

Our promise

Debt doesn’t define you

Debt can happen to anyone, job loss, unexpected expenses, or rising costs. We create a safe, supportive space where you can explore your debt options without fear or judgment. Our only goal is to help you get out of debt and take back your life.

How you can save

Use our consumer proposal calculator to see how much you can save

Note: This is an average repayment, however, each person’s circumstances will impact their repayment.

Find a trustee

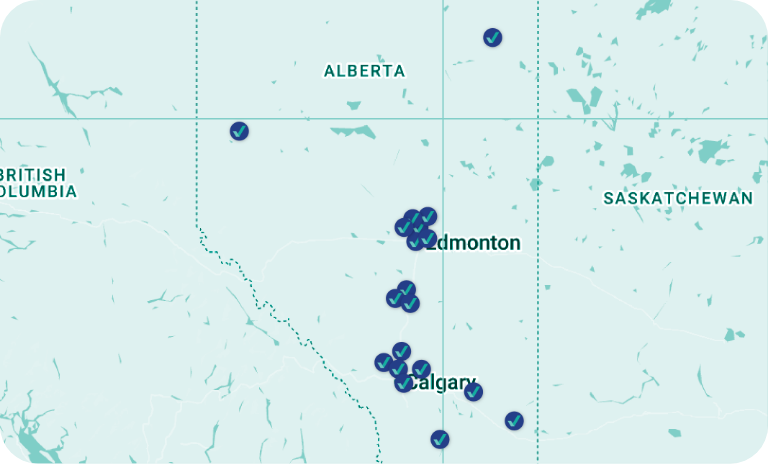

We serve Alberta

Whether you’re in Edmonton, Calgary, Red Deer, or another Alberta community, BNA is here to help. Our Licensed Insolvency Trustees are available to help across the province.

Ready for a fresh start

Take the first step to becoming debt free

Debt doesn’t have to control your life. We’ve helped thousands of Albertans get a true fresh start, and we can help you too. Let’s find the solution that’s right for you.

Tips & advice

Learn how to rebuild and thrive

Thousands of Albertans have left debt behind with BNA. Here’s what we’ve learned: