Navigating debt challenges can be overwhelming, especially when facing the prospect of wage garnishment in Canada. Yes, creditors or collection agencies can garnish wages, but there are specific steps and legal processes involved, including obtaining a court order. It’s crucial to understand your rights and the legal protections available to you to safeguard your finances.

In Canada, debtors have key defences against wage garnishment, such as negotiating with creditors, doing voluntary wage assignments, or exploring options like consumer proposals. These methods can provide relief from financial stress. Our team at BNA Debt Solutions offers guidance to ensure you’re aware of these solutions and how they can be tailored to fit your situation.

Exploring resources and getting expert advice can help you regain control of your finances and work toward a more secure future. Our compassionate approach is here to support you every step of the way.

Understanding Wage Garnishment in Canada

What Is Wage Garnishment?

Wage garnishment might sound intimidating, but it’s important to understand what it means and how it works. At its core, it’s a legal process where creditors or government agencies collect overdue debts directly from your paycheque. Knowing how it works and the protections you have can help you take control of the situation.

In Canada, this legal mechanism ensures that debts like overdue loans or unpaid taxes are collected. The wage garnishment order dictates the amount deducted from each paycheque, helping creditors recover what they are owed.

Types of Debt That Can Lead to Wage Garnishment

Certain debts, such as unpaid taxes or credit card bills, can lead to wage garnishment and affect your bank account. These include credit card debt, student loans, child support, tax debt, and personal loans. Each type of debt has different triggers for starting garnishment.

- Credit card debt – if unpaid, creditors may garnish wages.

- Personal loans – unpaid loans can lead to wage garnishment by creditors.

- Student loans – unpaid student loans may result in garnishment.

- Tax debts – the Canada Revenue Agency (CRA) can garnish wages for unpaid taxes.

- Child support payments – garnishment orders may be issued for back payments owed to a dependent or spouse.

Understanding which debts, such as those owed to a credit union, can impact your earnings is crucial for preparing and negotiating with creditors. It’s also good practice to consider options such as a consumer proposal, which can provide a structured repayment plan and avoid the more severe impact of wage garnishment.

Who Can Garnish Wages in Canada?

Wage garnishment may be court-ordered or non-court-ordered. Most creditors, such as credit card companies or private lenders, need a court judgment to garnish wages. However, some government debts, like taxes owed to the CRA or child support, do not require a court order.

Legal Process for Wage Garnishment in Canada

Facing legal action from creditors can feel overwhelming, but you have rights and protections. In most cases, creditors need a court order to garnish wages, and you’ll be notified before anything happens. Knowing what to expect can give you the confidence to address the situation and negotiate better terms. After obtaining approval, they notify both the debtor and the employer.

Employers play a crucial role, as they must begin the wage deductions according to the order. They must comply with legal stipulations, ensuring the correct amount is withheld each pay period.

Understanding this process can help individuals address wage garnishment effectively, emphasizing the importance of prompt communication and action to potentially negotiate better terms.

When Can a Debt Collector Garnish My Wages in Canada?

A debt collector can garnish wages in Canada only under certain conditions. Not all debts result in garnishment, and creditors must follow specific rules.

- Outstanding Debt: There must be an unpaid debt, such as credit card balances, personal loans, student loans, or tax liabilities.

- Court Order: In most cases, creditors must obtain a court order to garnish wages. This involves filing a lawsuit and winning a judgment against the debtor.

- Notification: Debtors are usually required to be notified of the lawsuit and allowed to respond before garnishment can occur.

- Legal Limitations: Laws limit the amount that can be garnished from an individual’s wages. For example, in Canada, the maximum garnishment amount is typically 30% of disposable income, depending on the jurisdiction.

- Exceptions: Certain debts, such as child support, may have different rules and may not require a court order for garnishment to occur.

- Bankruptcy Considerations: If an individual files for bankruptcy, wage garnishment may be temporarily halted, but specific procedures must be followed for creditors to collect owed debts post-bankruptcy.

For personalized advice and support, we recommend contacting professionals with expertise in debt solutions, such as licensed insolvency trustees at BNA Debt Solutions. We can guide you through understanding your rights and exploring debt relief options tailored to your situation.

Wage Garnishment Amounts and Exemptions

Wage garnishment in Canada is a legal process where a portion of your income can be taken by creditors to pay debts. The rules vary, protecting certain income types while setting limits on how much can be garnished.

How Much of My Wages Can Be Garnished?

In Canada, the amount of wages that can be garnished depends on the type of debt you owe. However, there are protections for low-income earners. If your monthly net income is below a certain threshold, a smaller portion of your wages can be taken, ensuring you have enough to cover basic living expenses.

Limits and Exemptions

Certain income types are protected from garnishment. Government benefits such as Employment Insurance, Social Assistance, and disability payments cannot usually be garnished. Additionally, retirement funds and some pension payments may also be protected.

Creditors and collection agencies must abide by these rules, ensuring that vulnerable income sources remain untouched. While most creditors can garnish wages, they cannot seize income from some of the protected sources. These exemptions provide critical financial relief for individuals receiving such benefits.

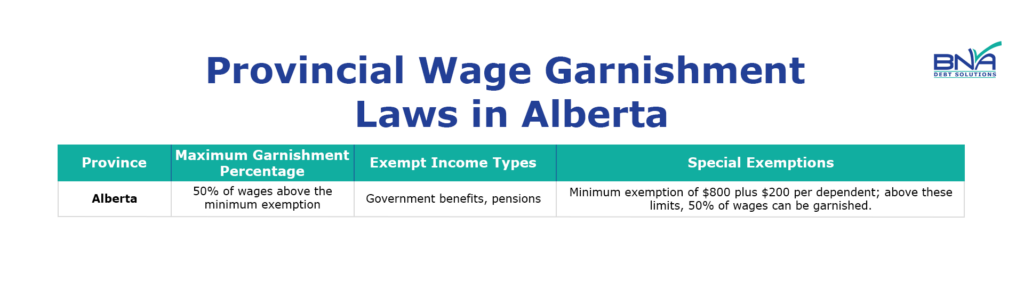

Provincial Wage Garnishment Laws in Alberta

Wage garnishment laws differ across provinces, so it’s important to know the specific details of where you live. Here’s an overview of the limits and exemptions in here in Alberta.

How to Stop Wage Garnishment in Canada: Solutions and Relief Options

If you’re facing wage garnishment, it’s natural to feel trapped but you’re not without options. Whether it’s negotiating directly with creditors, filing a consumer proposal, or seeking professional help, there are ways to stop garnishment and protect your income.

Together, we can find the solution that works best for you. The sooner a consumer proposal or bankruptcy is filed, the sooner the garnishment will stop.

We can explore negotiations with creditors, seek help from a Licensed Insolvency Trustee (LIT), and consider alternative debt relief solutions. Here are some effective ways to manage and potentially stop wage garnishment work.

Options to Stop Wage Garnishment

- Negotiate Directly with Creditors

Approaching creditors can sometimes help find a mutually agreeable solution. By reaching out, you may work out a repayment plan or lower payments to avoid garnishment. Direct contact shows a willingness to resolve the debt, which creditors might appreciate and agree to modify the terms. - Consumer Proposal

A consumer proposal is a legal process where you generally pay part of your debt over a period of 5 years. It benefits you by halting the wage garnishment once it is filed. This approach allows you to manage your debt responsibly, without the heavy implications of bankruptcy, and keep wage deductions at bay. - Filing for Bankruptcy

When you file for bankruptcy, the court will award you a stay of proceedings, which protects you against all legal action from your creditors. Bankruptcy is generally a last resort but can protect earnings from garnishment. Upon filing, creditors are legally required to stop collection activity. It’s crucial to understand this option’s long-term effects on credit and obligations. - Filing an Appeal or Garnishment Exemption

You can request a court to adjust the terms of garnishment due to financial hardship. If successful, this option can reduce the amount garnished from your wages. It’s often necessary to provide evidence of financial difficulty when pursuing this route.

When and How a Licensed Insolvency Trustee Can Help

Licensed Insolvency Trustees (LITs) are crucial in managing debt situations. A LIT can assess your financial situation and recommend suitable debt solutions like a consumer proposal or bankruptcy when garnishment looms. They guide you through the legal process, ensuring compliance and effective relief strategies.

We, as a team of professionals, have over 27 years of experience in helping Albertans navigate these challenges. We aim to offer supportive, respectful assistance without promoting bankruptcy as the first step.

Alternative Debt Relief Options

Besides consumer proposals and bankruptcy, several other debt relief strategies may apply. Debt consolidation loans can simplify payments by combining debts into one. Credit counselling can provide guidance on managing finances effectively.

Engaging with these options provides a path to manage debts without facing wage garnishment. We encourage exploring all available avenues to understand what best suits your financial standing. Engaging with trusted professionals can make this journey less daunting.

Know Your Rights as a Debtor Facing Wage Garnishment in Canada

Living under the threat of debt collection can be stressful. That’s why we at BNA Debt Solutions are here to support you.

Remember, you have options to manage debt responsibly. Reaching out for help is a brave step towards financial health. We’re here to make sure you know your rights and can face any financial challenge with confidence.

When to Seek Professional Help to Stop Wage Garnishment

Facing wage garnishment can be challenging. If you’re dealing with garnishment by the Canada Revenue Agency or other creditors, professional help can make a big difference.

The first step is understanding the legal protections available to you. When your financial standing is at risk, meeting with a licensed insolvency trustee can provide clarity.

You might wonder, when is the right time to consult a professional. It’s crucial if you owe money to creditors like credit card companies or payday loan lenders, and they have obtained a wage garnishment order. If your monthly net income is affected significantly, or if you’re at risk of losing further income or physical assets, seeking help is wise.

A Licensed Insolvency Trustee can help explain options such as a consumer proposal. This might allow you to stop wage garnishments and work out a repayment plan.

Common indicators when professional help is needed:

- Multiple garnishments: If wages can be garnished by more than one creditor.

- Unsecured debts: Including credit card debt or tax debt.

- Court orders: When a court order has been obtained against you.

- Complex financial situation: Multiple creditors or significant unpaid debts.

If you’re feeling the effects of less money coming in due to garnishment, we encourage you to discuss your situation with us. Our team can offer reassurance and guide you toward effective solutions.

Frequently Asked Questions

Can a collection agency garnish my wages in Canada without a court order?

Creditors generally need a court order to garnish wages in Canada. One exception is the Canada Revenue Agency (CRA), which does not require court approval to garnish wages for unpaid taxes. This highlights the importance of understanding your unique situation.

What is exempt from garnishment?

Certain income sources can be protected from garnishment. These exemptions often include Canada Pension Plan payments, Old Age Security, and sometimes child support payments. Understanding these exemptions can help you better manage your financial obligations.

What is the role of the Canadian Revenue Agency in wage garnishments?

The CRA has the authority to garnish wages without a court order. They collect unpaid taxes through this method. We advise staying informed on your tax responsibilities to avoid unexpected garnishments from the CRA.

Can multiple creditors garnish wages at the same time?

Wage garnishment is subject to limits. Typically, only one creditor can garnish wages at a time. If multiple creditors have claims, they must wait their turn. The priority order is often based on the nature of the debt, such as support payments taking precedence.

How can I know if my wages will be garnished?

You’ll receive a formal notice before garnishment begins. It usually follows a court order. If you’ve been contacted by creditors or received a legal notice, it’s crucial to respond promptly.

Will wage garnishment impact my job?

Canadian law protects employees from being fired or discriminated against due to wage garnishment. Your job security should not be influenced by garnishment, offering peace of mind while you address financial challenges.

BNA Debt Solutions: Your Trusted Partner for Debt Relief

BNA Debt Solutions is a family-owned business with over 27 years of experience in Alberta. Our licensed insolvency trustees are committed to offering transparent and personalized debt solutions. We are here to provide support and empower you through options like consumer proposals, which is often the best option over bankruptcy.

Our approach is centred on integrity, respect, and understanding. We aim to relieve financial stress while maintaining your dignity. From tax debts to complicated financial situations, we handle it all with professionalism and empathy. Our team is well-equipped to navigate these challenges alongside you.

Why Choose Us

- Customised Solutions: We tailor our strategies to fit your unique financial needs.

- Expert Guidance: Our trustees offer professional advice you can trust.

- Focus on Empowerment: We prioritize solutions that empower and respect you.

Feel burdened by debt or facing legal action? Our firm prioritizes not just solving the immediate problem, but also providing sustainable, long-term financial health. We work closely with you to understand your circumstances and find solutions that avoid severe alternatives like garnishing wages.

You don’t have to face wage garnishment–or the stress of debt–alone. It’s easy to feel ashamed when facing financial challenges but remember: debt doesn’t define you. Seeking help is a sign of strength, not failure. At BNA Debt Solutions, we’ll guide you toward relief with compassion and expertise.