Get in Touch: (403) 232-6220

Leave Debt Behind—Your Fresh Start Is Just One Step Away

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

At BNA Debt Solutions, we truly understand the emotional weight of debt and how it can affect every aspect of your life. That’s why we’re committed to offering compassionate, judgment-free support tailored to your unique situation.

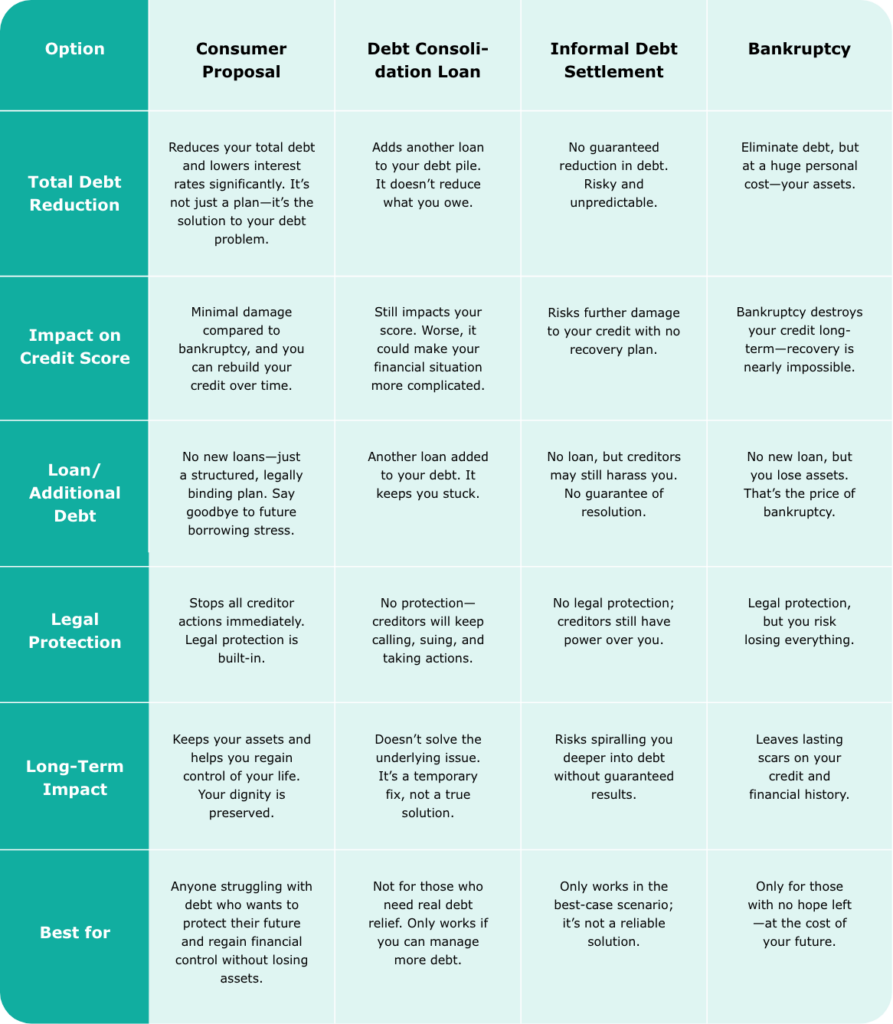

Through a consumer proposal in Lethbridge, you can take control of your finances without the need for bankruptcy. This legal agreement allows you to reduce your debt and create a repayment plan that fits your lifestyle. It’s about giving you the relief and hope you deserve, so you can focus on building a future you’re proud of.

It's normal to feel uneasy about what debt may bring, though we are here to support and educate you each step of the way. A consumer proposal doesn’t typically require giving up essential assets. Unlike declaring bankruptcy, this option allows individuals to keep their possessions, and with our guidance, we can help negotiate terms to protect your property.

A consumer proposal actually reduces your debt. By repaying just a portion, you can regain control over your finances. With our help, we can create a manageable and fair plan for you.

While a consumer proposal does appear on your credit report, it’s less damaging than filing bankruptcy and offers a clear path to rebuilding credit. We’ll help you understand how this process effectively manages your debt.

Concerns about legal threats are common. Filing a consumer proposal stops all collection actions, including wage garnishments and calls. This gives you peace of mind and lets you focus on repayment without ongoing legal stress.

A consumer proposal offers a legal and effective way to settle your debts by creating a formal agreement with your creditors. It’s a lifeline, helping you manage your finances without the drastic step of bankruptcy.

This is your chance to regain control—to reduce what you owe and move forward with hope and relief. Instead of feeling overwhelmed, a consumer proposal provides a clear path to overcoming your financial struggles and rebuilding your future. At BNA Debt Solutions, we’re here to be the shoulder you can lean on.

With a consumer proposal, you don’t have to face bankruptcy—you can reduce what you owe and retake control. For over 27 years, we’ve been helping Albertans, including families in Lethbridge, regain their financial stability.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

Initial Consultation with BNA Debt Solutions

Your journey begins with a free consultation where we take the time to truly understand your financial situation and explore debt relief options tailored to your needs. During this meeting, you will get clear, honest advice about how a consumer proposal in Lethbridge can help you eliminate your debt while avoiding bankruptcy.

Role of Licensed Insolvency Trustees

With over 27 years of experience, our Licensed Insolvency Trustees will guide you through the consumer proposal process, which is a legally binding agreement designed to simplify your debt situation. They’ll negotiate directly with all your creditors on your behalf, helping to lower your interest rates and reduce the amount you owe.

Agreement on a Monthly Payment Plan

Once we’ve assessed your finances, we’ll create an affordable monthly payment plan that fits your budget. No more high-interest rates or overwhelming bills. You will make regular payments based on your income, providing you with the relief knowing that your credit history and credit report will improve as you pay down your debts.

Settlement with Creditors

The consumer proposal becomes a legally binding process between you and your creditors. This gives you the certainty that your debts will be settled under one unified plan, allowing you to focus on what truly matters—building a fresh financial future. With BNA Debt Solutions, you will have the right debt solution to overcome your financial difficulty and finally achieve the peace of mind you deserve.

Let us show you how we can simplify your financial situation and give you the fresh start you deserve.

To qualify for a consumer proposal in Lethbridge, you’ll need at least $1,000 in unsecured debt and your total unsecured debts (excluding mortgages) are under $250,000. You’ll also need to show you can make regular, affordable payments. If your debts feel overwhelming or exceed your assets, this solution offers a manageable alternative to bankruptcy for Canadian residents and property owners.

A Licensed Insolvency Trustee will work with you to create a plan that fits your unique situation. It’s not just about the numbers—it’s about giving you the space to rebuild your life and find peace of mind. You’re not alone in this journey; there’s a path forward, and it starts right here.

With over 27 years of experience helping people in Lethbridge and Alberta, BNA Debt Solutions has earned a reputation for reliability and results. Our track record of success means you can trust us to guide you through your debt relief journey.

We understand that every financial situation is unique. A consumer proposal at BNA is explicitly tailored to your needs, ensuring your monthly payments are manageable and your debt burden is lightened.

At BNA, we believe in transparency. Our team offers clear, honest advice with no hidden fees or surprises, ensuring you fully understand your debt relief options and feel confident moving forward.

You don't have to wait long to feel relief. Filing a consumer proposal stops creditor calls immediately, and with a manageable repayment plan, you gain long-term financial stability without the stress of constant debt.

Our focus is on finding the best debt solution for your specific situation. We won't try to upsell unnecessary services; we'll just provide a clear, simple, and effective plan to help you achieve a debt-free future.

With the support of a Licensed Insolvency Trustee, you'll have a trusted expert guiding you every step of the way, ensuring the legally binding process is smooth and that your debt is resolved in a way that works for you.

A Licensed Insolvency Trustee is essential in guiding you through a consumer proposal, ensuring every step is transparent and manageable. As a licensed and trusted debt relief provider, we’re here to walk with you through the legal process, offering support with patience and understanding.

Our team focuses on solutions that ease your financial burden and honour your dignity and trust. At BNA, you’ll find not just experts, but a dedicated team committed to helping you achieve a brighter, stress-free financial future.

We know how heavy the debt burden can feel, but BNA Debt Solutions is here to help you find peace and financial freedom. You don't have to face this alone—let's take the first step toward a brighter, debt-free future together.

We’ve worked hard to earn the trust of Albertans for over 25 years.

We’re proud to be recognized for our commitment to excellence and transparency.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

A consumer proposal in Lethbridge offers a debt relief solution for reducing unsecured debts like credit card statements. It works by negotiating with creditors to lower the debt, stop interest rates, and help you avoid bankruptcy.

A licensed bankruptcy trustee in Lethbridge guides you through debt relief solutions like consumer proposals. They help negotiate with creditors to reduce unsecured debts and manage payments, offering a clear path to resolve financial difficulties without filing for personal bankruptcy.

Credit counselling in Canada provides essential strategies to manage unsecured debts and improve your credit rating. By understanding your finances and budgeting, you can tackle financial difficulties and explore options like consumer proposals to avoid bankruptcy.

Informal debt settlements may reduce some unsecured debts without a formal agreement, unlike a consumer proposal. Bankruptcy involves a personal bankruptcy filing, where you may lose assets. A consumer proposal is a safer alternative to avoid these severe consequences.

Paying a lump sum through a consumer proposal reduces overall debt and stops accruing interest. This can improve your credit rating over time, helping you recover financially in Lethbridge and Canada while avoiding bankruptcy.

Yes, a consumer proposal in Lethbridge can help you avoid bankruptcy by reducing unsecured debts and interest rates. It allows manageable payments and legal protection, giving you peace of mind as you regain control over your finances and rebuild your credit rating.