Honest, Judgment-Free Help from Strathmore’s Trusted Debt Experts

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

If you’re in Strathmore, feeling the weight of debt, you’re not alone. Nearly 1 in 3 Albertans struggles with financial stress, and in neighbourhoods like Lakewood, Edgefield, and Aspen Creek, we’ve seen neighbours face the same challenges. For over 27 years, BNA Debt Solutions has been Strathmore’s trusted source for honest, judgment-free debt relief, led by Alberta’s most experienced insolvency professionals.

A consumer proposal in Strathmore is your chance to ease creditor pressure, protect your home, and rebuild with confidence. Let’s take the first step together.

High interest rates can make debt feel unstoppable. A consumer proposal freezes interest, consolidating credit card debt and loans into one affordable monthly payment, tailored to your Strathmore budget.

Collection calls and wage garnishments can steal your peace. A consumer proposal stops them immediately, giving you space to breathe, guided by our caring Licensed Insolvency Trustees.

Your credit may have taken a hit, but there’s hope for rebuilding it. Each steady payment in a consumer proposal strengthens your credit report, paving the way for a brighter future in Strathmore.

Protect your home and vehicle while addressing unsecured debt. A consumer proposal helps preserve your peace of mind and financial stability. Our Licensed Insolvency Trustees are here to guide you with care, every step of the way.

For 27 years, we’ve supported Strathmore families through tough times—earning over 200 five-star reviews and recognition as one of the top three Licensed Insolvency Trustees in Calgary by the 2025 Three Best Rated® (Canada).

Debt can feel like a heavy fog, but in Strathmore, a consumer proposal lifts the burden. Imagine Jane, a single mom in Hillview, juggling two jobs just to make ends meet. Every day, the weight of $35,000 in credit card debt hung over her. Late fees, creditor calls, and sleepless nights were a constant reminder of her financial strain. However, with the support of BNA Debt Solutions, her trustee helped her reduce her debt to $21,000, giving her room to breathe and regain control of her finances.

Could a Consumer Proposal Be Right for You?

You have unsecured debts, like credit cards or loans, up to $250,000, excluding your mortgage.

You can manage monthly payments that fit your financial situation.

You seek relief without risking your home or car through bankruptcy.

You’re facing creditor pressures, like collection calls, but have income to repay part of your debt.

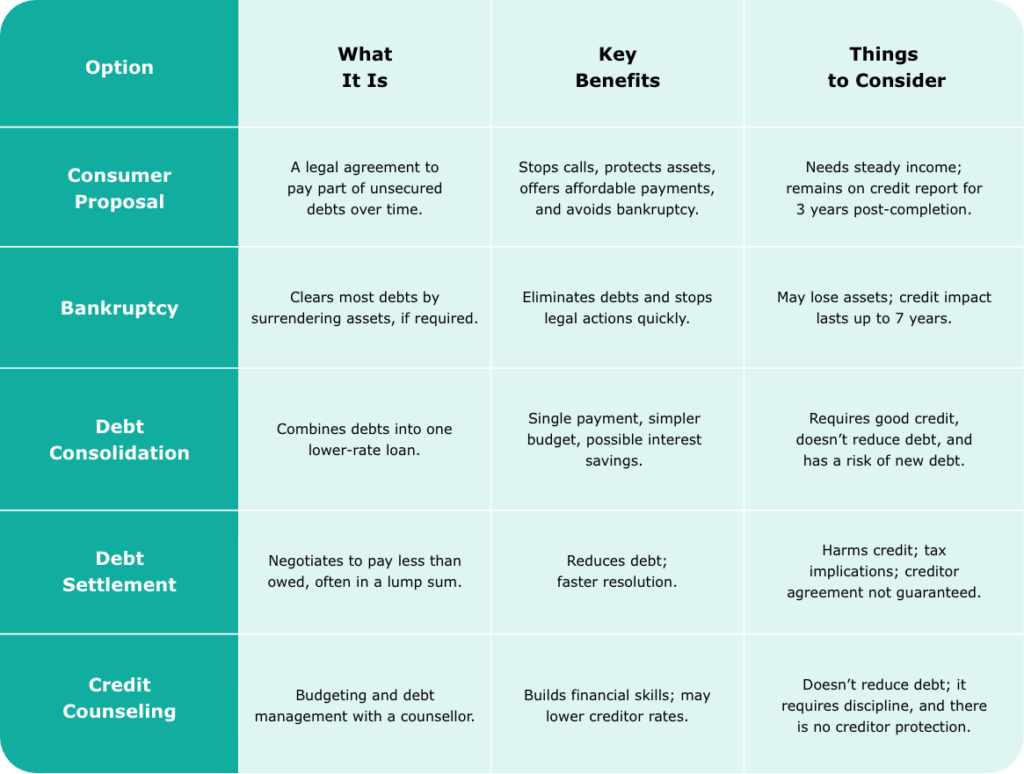

No matter your circumstances, we’re your Strathmore neighbours, committed to finding a solution that works. If a consumer proposal isn’t the best path, we’ll explore debt consolidation options, such as a debt consolidation loan, which merges debts into one manageable payment. At BNA Debt Solutions, our Licensed Insolvency Trustees provide personalized support, including two counselling sessions to empower your financial journey.

Debt’s heavy, but you don’t have to carry it alone. Let’s find a consumer proposal or another solution that feels right for your life. Our Licensed Insolvency Trustees are ready to help, with no judgment.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

In Strathmore, where every dollar counts, a consumer proposal lets you keep your home and car while paying less to unsecured creditors like credit card companies or the Canada Revenue Agency. It’s a solution that fits your budget, stops harassment, and helps you rebuild with dignity.

This solution reduces stress from collection calls and legal threats, empowering you to regain financial stability with dignity.

Debt can feel overwhelming, especially when it seems like bankruptcy is the only option. But while it may offer quick relief, bankruptcy often comes with long-term consequences like a damaged credit score and a lasting public record. At BNA Debt Solutions, we believe there’s a better way. We’re here to help you explore every option with clarity and compassion.

Unlike bankruptcy, which may require giving up your home or vehicle, a consumer proposal allows you to reduce what you owe while keeping the things that matter most. It’s a practical, respectful solution that helps you protect your assets and rebuild your credit—one step at a time.

Debt can feel like it’s stealing your peace of mind. If you’re in Strathmore, let’s change that with a consumer proposal or a plan that truly fits your life. Book a free, friendly call—online, by phone, or in person.

Debt can feel like a shadow over your life. We get it. At BNA Debt Solutions, we’re here to lift that weight. Our trusted Licensed Insolvency Trustees are ready to guide you through a consumer proposal, offering support and compassion every step of the way.

Step-by-Step Process:

Free Consultation: A friendly, private call to hear your worries, exploring your finances with patience.

Review Your Finances: We examine your debts, such as credit card debt and income, to find a plan that fits you.

Work with a Trustee: Your Licensed Insolvency Trustee creates a consumer proposal specifically for you. It’s customized to fit your budget.

Submission & Negotiation: We handle creditor talks, taking the stress off your shoulders.

Final Agreement: Affordable payments start your path to relief, secure and supported.

For 27 years, we’ve walked with Strathmore residents through financial struggles, offering debt relief with care. Our Licensed Insolvency Trustees provide dependable consumer proposals to lift your worries, with no judgment.

Your financial situation is unique. We tailor consumer proposals to fit your budget, finding debt relief that feels personal rather than cookie-cutter.

Are you lost in debt options? We keep it simple, explaining costs and steps openly. Our Alberta team gives you straightforward guidance on how to contact us—no surprises, just clarity.

Collection calls stealing your peace? We stop them and help you reclaim financial peace—step by step, with care.

We focus on your ability to repay, not upselling. Our goal is your peace of mind, delivered with heartfelt care.

Trust us to handle one or more creditors with care. Our Licensed Insolvency Trustees make your first step toward debt relief feel safe.

Debt can feel overwhelming, but there’s a way forward. At BNA Debt Solutions, we’re here to ease your financial difficulties with a plan that feels right, helping you breathe easier without judgment.

Reduce Overall Debt: A consumer proposal lowers debt owed to unsecured creditors, such as credit card debt, saving you money and protecting your future.

Avoid Bankruptcy and Protect Assets: Skip bankruptcy and keep your home under the guidance of a licensed insolvency trustee.

Stop Creditor Harassment: End collection calls fast, reclaiming peaceful Strathmore evenings.

Achieve Manageable Monthly Payments: Affordable payments tailored to your budget, making debt relief real.

Safeguard Your Credit Rating: Limit credit report damage and rebuild toward financial freedom.

Debt can weigh heavily, but there’s a path forward. A consumer proposal offers a structured, realistic solution to help you regain control. At BNA Debt Solutions, we’re your Strathmore neighbours, here to help you find relief with clarity and compassion.

Strathmore’s heart lies in its farms, small businesses, and close-knit communities like The Ranch, Wildflower, and Cambridge Glen. However, financial stress is a growing reality with the average consumer debt nearing $85,000. Whether you live in Edgefield, Strathmore Lakes Estates, or anywhere in between, BNA Debt Solutions is here with personalized debt relief plans that fit your life. Meet with us in person, connect virtually, or call—we’ll make the process easy and judgment-free.

Our Licensed Insolvency Trustees aren’t just experienced professionals—they’re people who understand what you’re going through. With over 200 five-star reviews and a BBB A+ Rating, we’ve helped thousands across Alberta regain control. Whether it’s a consumer proposal or a debt consolidation loan, we’ll guide you through your options with clarity and care.

We know how heavy the debt burden can feel, but BNA Debt Solutions is here to help you find peace and financial freedom. You don't have to face this alone—let's take the first step toward a brighter, debt-free future together.

We take pride in being recognized for our exceptional service across Alberta. Our mission is to simplify complex financial solutions and provide you with a stress-free experience so you never have to face these challenges alone.

Your community deserves brighter days—let’s craft your debt relief plan. Book a free consultation to explore a consumer proposal or other options with our Licensed Insolvency Trustees, stress-free.

Creditors’ acceptance or refusal of a proposal counts as a vote based on the total dollar value of proven claims. This means the larger the claim, the more weight the vote carries in determining if the proposal is accepted or rejected.

After a consumer proposal is filed, creditors have 45 days to vote on it. This time frame allows creditors to review the proposal and decide whether they will accept the terms set forth for debt repayment.

Payments in a consumer proposal are made through a Licensed Insolvency Trustee. The trustee ensures the agreed-upon amounts are disbursed to each of your creditors based on the terms outlined in the proposal, providing a structured and reliable payment process.

A consumer proposal will impact your credit rating, but it’s less severe than bankruptcy. A note will stay on your credit report for up to 3 years after completing the proposal, but it’s a much better option than facing bankruptcy’s long-lasting credit damage.

Only a Licensed Insolvency Trustee (LIT) is legally authorized to file a consumer proposal on your behalf. These federally regulated professionals manage all required documentation and ensure the process complies with Canada’s Bankruptcy and Insolvency Act.