Get in Touch: (403) 232-6220

From Debt Pressure to Peace of Mind, Your Fresh Start Begins Today

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

If you’re feeling overwhelmed by unsecured debt and persistent creditor calls, you’re not alone. At BNA Debt Solutions, we understand how challenging things can become. For 27 years, we’ve been assisting families in Cochrane in regaining control of their finances, providing debt relief through consumer proposals tailored just for you.

Whether you’re facing mounting bills in Cochrane, Alberta, or feel like you’re running out of options, our team of compassionate Licensed Insolvency Trustees (LITs) is here to guide you through the process. We will help you establish affordable monthly payments, freeze interest rates, and stop creditor harassment, all without needing to declare bankruptcy.

A consumer proposal provides more positive benefits then you think and will turn common misconceptions into a feeling of relief.

A consumer proposal in Cochrane isn't just a form to fill out; it's a powerful legal tool that transforms the uncertainty of overwhelming debt into a clear, actionable plan. With the guidance of a Licensed Insolvency Trustee, you can regain control and start to see a clear way forward.

Let's make your debt relief plan simple. By consolidating your unsecured debt into one manageable payment, we'll help you carve out space in your budget for the essentials, so you can focus on living without the constant worry of bills piling up.

When you file a consumer proposal, the legal process provides you with immediate relief and an automatic stay that ends harassment from unsecured creditors, freezes interest rates, and stops legal actions, including tax garnishments or offsets from the Canada Revenue Agency (CRA), giving you immediate protection under federal law.

While a consumer proposal results in an R7 credit rating, each on-time payment helps demonstrate responsibility and starts you on the path to rebuilding your credit over time.

A consumer proposal might be the fresh start you’ve been searching for. It’s a legal option that allows you to reduce your unsecured debt to a manageable amount, so you can pay it off at a pace that works for you, without the harsh consequences of bankruptcy.

Here’s what you need to know about eligibility:

You have unsecured debt up to $250,000 (excluding your mortgage).

You can commit to monthly payments toward your debt.

You’re a Canadian resident, ready for a change.

You’ll work with a Licensed Insolvency Trustee to guide the process.

A consumer proposal can stop creditor calls, freeze interest rates, and help you tackle your debt with manageable terms, all while protecting your credit and honoring your payments to secured creditors, avoiding bankruptcy. This isn’t about judgment—it’s about finding real, practical solutions.

Debt can feel like foothill fog, but we will guide you to clearer skies. Let's explore a consumer proposal or another option that suits life in Cochrane; no judgment, just solutions.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

Cochrane’s scenic neighbourhoods, like Fireside, Heartland, and Bow Ridge, are full of charm, but debt problems can weigh heavily, no matter where you live. Whether you’re in Sunset Ridge or Cimarron, BNA Debt Solutions is here with personalized debt relief plans that fit your life. We offer in-person, phone, or virtual appointments to make the process easy, flexible, and judgment-free.

Our licensed insolvency trustee firm is more than just experts; they’re people who understand what you’re going through. With over 230+ reviews and a BBB A+ rating, we’ve helped thousands across Alberta regain control. Whether it’s a consumer proposal or a debt consolidation loan, we’ll guide you through your options with care and clarity so that you can take the next step toward a debt-free future.

At BNA Debt Solutions, our Licensed Insolvency Trustees are here to help you, offering support that’s both professional and understanding. Appointed by the federal government, our trustees have a responsibility to both you and your creditors, ensuring fair treatment throughout the entire process.

We understand that dealing with debt problems is stressful, but with us, you won’t face them alone. Whether you’re managing monthly payments, preparing a fair proposal for your creditors, or finding the right debt consolidation options, our trustees are here to guide you through the process with clarity and care.

Our focus is on your well-being. We provide clear advice and ensure you feel confident about your options. No matter where you are in your journey, we’re here to support you, offering real solutions to help you move forward without judgment or pressure.

Bills piling up? We understand. A consumer proposal might be the fresh start you need. Let's explore it together in a friendly, pressure-free chat.

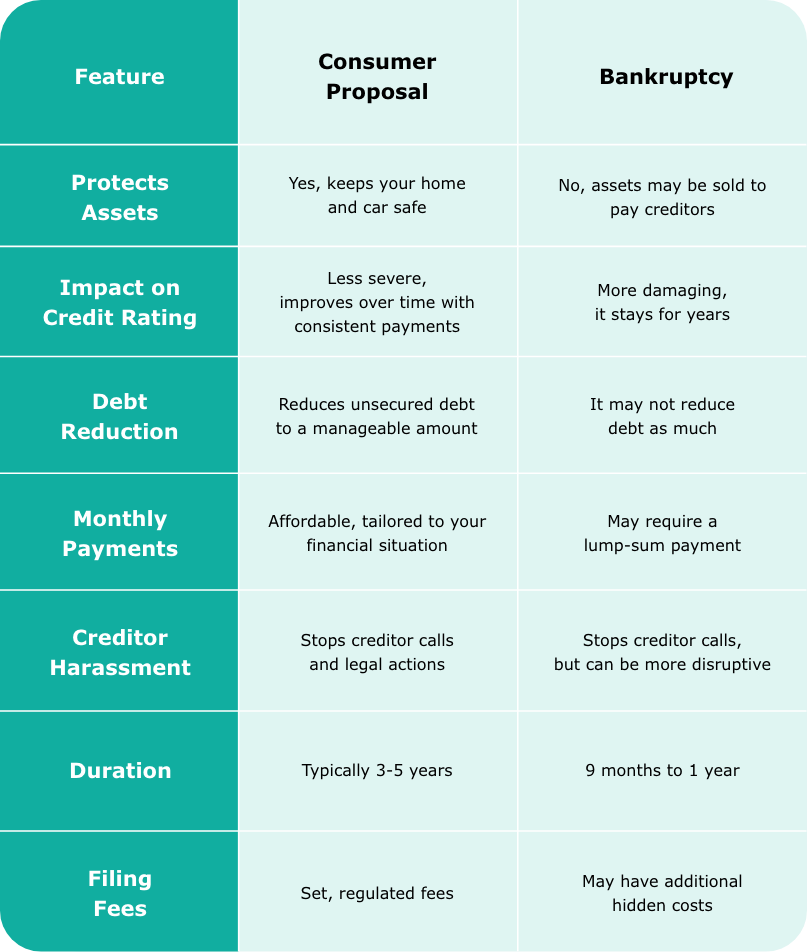

In Cochrane, more and more locals are turning to consumer proposals as a smart alternative to bankruptcy. Here’s why it’s the preferred choice for tackling financial difficulties while keeping control of your future:

Protect your home and car from liquidation

Pay off unsecured debt in affordable monthly payments

Freeze interest rates and stop creditor calls

Rebuild your credit rating faster than bankruptcy

Avoid the bankruptcy process and its long-term consequences

A consumer proposal in Cochrane offers debt relief that works for you. It helps you manage unsecured debt while avoiding the harsh consequences of filing for bankruptcy. BNA Debt Solutions is here to guide you every step of the way, ensuring you feel supported, not judged.

For almost three decades, we've guided Albertans through financial problems, offering support that's rooted in honesty, empathy, and heart.

Your Cochrane budget is unique. We create a consumer proposal with monthly payments that fit your financial situation. There are no one-size-fits-all solutions here.

All fees are federally regulated and explained upfront, so you never have to worry about hidden costs. We believe in complete transparency throughout the consumer proposal process.

The moment you file, the pressure stops. Collection calls cease, giving you the room you need to breathe, plan, and move forward without stress.

We focus on protecting what matters—your home, your vehicle, and your peace of mind.

Our Licensed Insolvency Trustees are here to translate every legal step into clear, caring guidance. We'll make sure you understand each part of the process and feel supported at every turn.

As you can see, a consumer proposal allows you to manage your debt in a way that works for your life, helping you keep what’s important while avoiding bankruptcy. BNA Debt Solutions offers personalized guidance to help you navigate your options, with no judgment, just support.

We know how heavy the debt burden can feel, but BNA Debt Solutions is here to help you find peace and financial freedom. You don't have to face this alone—let's take the first step toward a brighter, debt-free future together.

BNA has spent 27 years meeting Albertans where they are, transforming debt challenges into clear, hopeful plans. We’re honoured to walk beside the Cochrane community as their reliable ally for meaningful debt solutions.

Debt isn't your story. Book a free consultation here in Cochrane or online, and let's find a consumer proposal or path that restores your calm. No pressure, just support.

A consumer proposal cannot exceed five years in duration. It’s a structured plan to repay unsecured debt over a set period. The exact term is based on your financial situation but will not extend beyond five years.

Legally, you must owe at least $1,000 in unsecured debt to qualify. This can include credit card balances, personal loans, payday loans, and other unsecured obligations. However, consumer proposals are typically most effective for individuals with larger debt loads—usually $10,000 or more—where the benefits of reduced payments and protection from creditors outweigh the administrative costs.

Once a consumer proposal is filed, creditors have 45 days to vote on whether to accept or reject it. If the majority of creditors approve the proposal, it becomes legally binding. If rejected, alternative options like bankruptcy may be considered.

If the creditors do not accept a consumer proposal, you may need to explore other options like bankruptcy or debt consolidation. These options can also help manage unsecured debt, but come with different consequences and requirements.

To be legally binding, a consumer proposal must be created by a Licensed Insolvency Trustee. Only a government-approved bankruptcy trustee can file the proposal paperwork and handle the consumer proposal process, ensuring fairness to both you and creditors.

A consumer proposal can affect your credit rating, but it offers a less severe impact compared to bankruptcy. It helps to rebuild your credit report over time by reducing unsecured debt and avoiding the consequences of filing for bankruptcy.