Alberta Insolvency Filings – When you are in debt you often feel alone, and like nobody is going through the same thing or knows what it feels like to be there. Well let me you, it is way more common than you think.

Alberta Insolvency Filings – When you are in debt you often feel alone, and like nobody is going through the same thing or knows what it feels like to be there. Well let me you, it is way more common than you think.

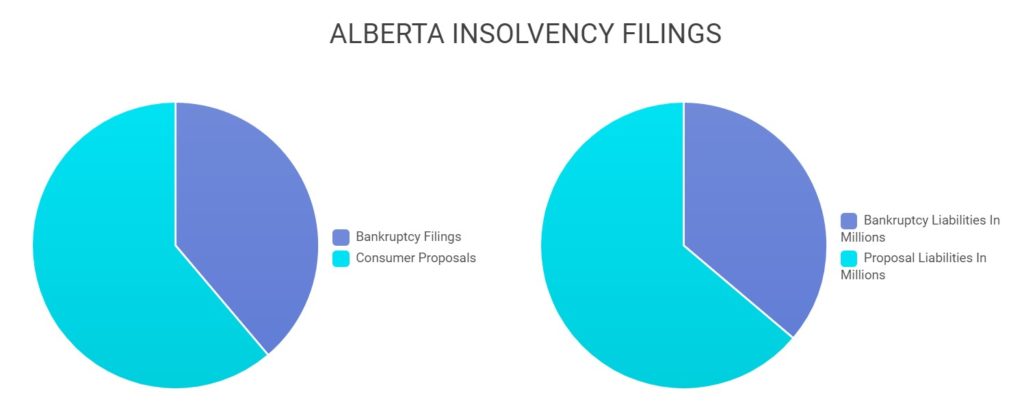

In May 2017 in Alberta alone, 460 people filed for Bankruptcy and listed $81,865,400 in liabilities and 725 people filed Consumer Proposals with liabilities of $143,015,136 million dollars.

So, in Alberta, in ONE month there were 1185 people who sought the services of a licensed Insolvency Trustee to help them legally deal with 225 Million dollars of debt. You are definitely not alone.

Why are we seeing numbers like this? To start, the Bank of Canada has started to raise interest rates. While 0.25% doesn’t seem like much it serves as an indicator that banks will start raising interest rates on their products which include a lot of unsecured debt. This puts pressure on monthly payments when they come due. The reality is that many of us are used to carrying high unsecured debt loads because and many just make the minimum payment. The universal laws of compound interest start to catch us when interest rates go up, accelerating the point at which we can’t make our monthly payments anymore.

In May 2017 in Alberta alone, 460 people filed for Bankruptcy and listed $81,865,400 in liabilities and 725 people filed Consumer Proposals with liabilities of $143,015,136 million dollars.

So, in Alberta, in ONE month there were 1185 people who sought the services of a licensed Insolvency Trustee to help them legally deal with 225 Million dollars of debt. You are definitely not alone.

Why are we seeing numbers like this? To start, the Bank of Canada has started to raise interest rates. While 0.25% doesn’t seem like much it serves as an indicator that banks will start raising interest rates on their products which include a lot of unsecured debt. This puts pressure on monthly payments when they come due. The reality is that many of us are used to carrying high unsecured debt loads because and many just make the minimum payment. The universal laws of compound interest start to catch us when interest rates go up, accelerating the point at which we can’t make our monthly payments anymore.