Get in Touch: (403) 232-6220

Leave Debt Behind – Your Fresh Start Is Just One Step Away

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

Debt is more than numbers—it’s that uneasy feeling about your future. For many in Airdrie, finding relief feels out of reach. But with a consumer proposal, you can protect what matters most and move forward confidently.

At BNA Debt Solutions, we’ve spent over 27 years helping Albertans navigate the toughest financial challenges with care and understanding. You’re not alone in this—we’re here to provide options that fit your unique needs and help you rebuild at your own pace. Let’s start your journey to debt relief together.

Debt can feel overwhelming, but a consumer proposal offers a clear way to regain balance. Many in Airdrie have found relief through this flexible solution, which reduces stress, improves sleep, and helps rebuild relationships. Taking that first step can lead to lasting peace of mind.

Acting early with a consumer proposal can safeguard your finances and prevent challenges like wage garnishments or persistent creditor calls. This legally binding agreement lets you protect key assets, like your home or car, while staying in control of your financial future.

Addressing your debt through a consumer proposal gives you the chance to stop penalties and interest from growing. By starting now, you can secure financial stability and focus on creating a confident future for yourself and your loved ones.

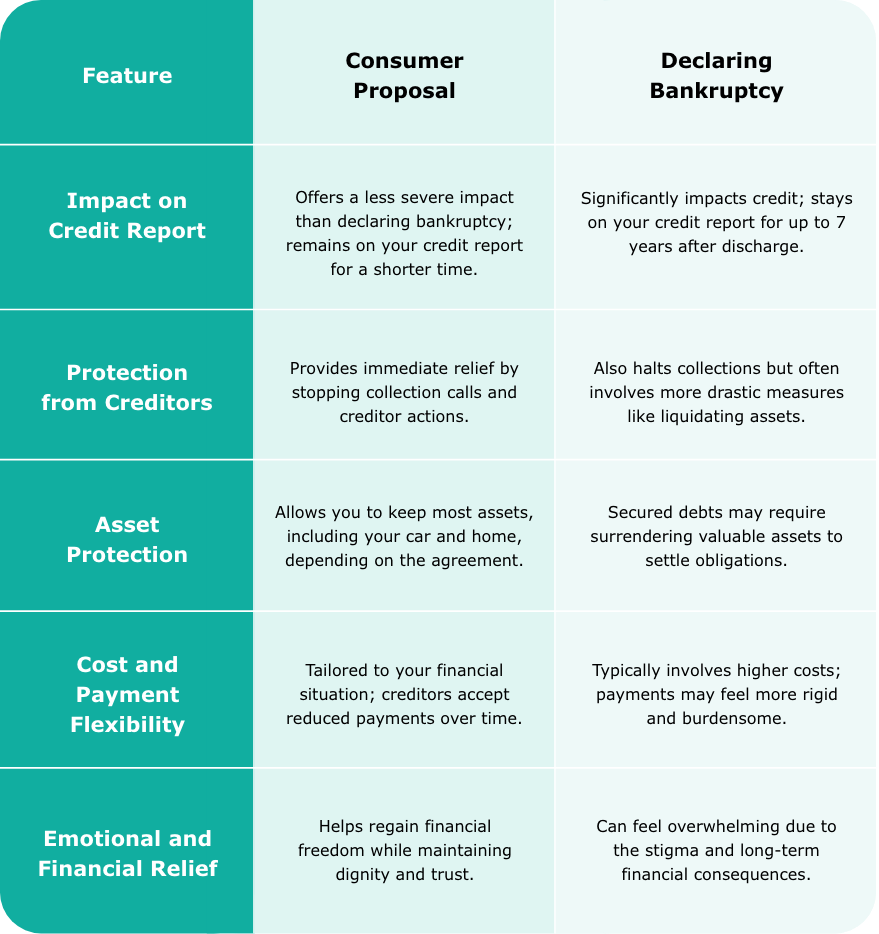

No matter how overwhelming things may feel, solutions are available to help you confidently move forward. Working with a Licensed Insolvency Trustee can help you explore options like consumer proposals, allowing you to regain control over your finances without declaring bankruptcy.

A consumer proposal is a formal agreement negotiated with creditors, allowing you to repay only a portion of your debt over a manageable time frame. This option is less severe than declaring personal bankruptcy and helps to relieve financial stress.

In Airdrie, Alberta, many individuals find that they can halt active collection activity and protect their assets by opting for a consumer proposal. Working with a Licensed Insolvency Trustee (LIT) allows us to tailor the same consumer proposal services to your unique financial circumstances, ensuring a solution that suits your needs.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

Filing a consumer proposal doesn’t have to feel overwhelming—it’s simpler than you might think. We’re here to walk you through every step, from your first consultation and consumer proposal work to the final agreement, breaking everything down in a way that’s easy to understand. With clear guidance and support, you’ll always know what’s coming next and how we’ll handle it together.

Let us show you how we can simplify your financial situation and give you the fresh start you deserve.

Once your proposal is approved, you can start making the agreed monthly payments. This stops active collection and credit-due activity and gives you the breathing room to manage other expenses.

We will track your payments and ensure that everything stays as planned. Our team will be by your side, providing support and ensuring your financial situation remains stable. This is key to maintaining trust, keeping you informed, and adjusting monthly payment, if needed.

We've been serving Albertans with dedication and trust. Our expertise and strong reputation make us a reliable choice for anyone in Airdrie seeking debt relief.

From Silver Creek to Coopers Crossing, we tailor consumer proposals to fit your unique situation and budget. Your financial relief should reflect your specific needs, not just a generic solution.

We promise transparent, upfront advice without hidden fees. Trust us to provide solutions that put your best interests first.

Imagine no more creditor calls and a clear path to financial relief. We aim for immediate and long-term results for your peace of mind.

Our priority is finding the right solution for you. We won't push unnecessary services—just genuine support and the right solutions.

Our Licensed Insolvency Trustees are actively involved, ensuring experienced professionals guide every step. Rest assured, you're in trusted hands throughout your debt relief journey.

Qualifying for a consumer proposal means having at least $1,000 in unsecured debt and your total unsecured debts (excluding mortgages) are under $250,000. You’ll also need to show you can afford smaller, more manageable payments. This solution is ideal if your debts exceed your assets or payments feel unmanageable, offering a practical alternative to bankruptcy.

With a Licensed Insolvency Trustee by your side, you’ll explore a plan that truly fits your needs. This is not just about numbers—it’s about giving you the breathing room to rebuild your life and find peace of mind again. You don’t have to face this alone; there’s a way forward, and it starts here.

Get Expert Advice on Whether a Consumer Proposal Fits Your Situation

We know deciding between a consumer proposal and bankruptcy isn’t easy. Our Licensed Insolvency Trustees at BNA Debt Solutions offer free, personalized consultations to guide you through this choice. Whether you’re managing unsecured debts or concerned about proposal payments, our experts understand your situation.

We proudly serve residents across Airdrie and its surrounding areas, offering expert debt relief solutions tailored to your needs. Our services are available to individuals in popular neighborhoods like Kings Heights, Ravenswood, Coopers Crossing, and Bayside. We also assist those in nearby communities, including Crossfield, Balzac, and other parts of Rocky View County.

For those near Airdrie’s key landmarks like the Airdrie Farmers’ Market, Nose Creek Park, or the Genesis Place Recreation Centre, we’re just a call away. Whether you prefer an in-person consultation, a remote video call, or phone assistance, our Licensed Insolvency Trustees are here to help. Wherever you are in Airdrie, relief is within reach.

Break free from the stress of debt and reclaim control of your life. A consumer proposal can protect your assets, stop creditor calls, and provide a clear path to stability. Take the first step today and move toward a future filled with confidence, peace, and financial freedom.

How to Get Started

Free Consultation: Take the first step with a free consultation. We’re here to support you, whether you prefer to connect remotely or in person.

Plan Together: Our team helps create a strategy that suits your needs and budget.

Move Forward: Take the first step toward financial freedom with our support.

We’ve worked hard to earn the trust of Albertans for over 25 years. We’re proud to be recognized for our commitment to excellence and transparency.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

No, only a Licensed Insolvency Trustee can file consumer proposals. Non-profit credit counsellors provide advice but cannot create legally binding agreements like a consumer proposal.

Yes, consumer proposals are governed by federal law, ensuring creditors receive payment under terms that respect your financial situation and rights.

Licensed trustees operate under federal government regulations, providing impartial and legally binding solutions, unlike for-profit companies that often charge higher fees.

Paying a lump sum through a consumer proposal reduces overall debt and stops accruing interest. This can improve your credit rating over time, helping you recover financially in Airdrie and Canada while avoiding bankruptcy.

Once accepted, your proposal becomes a legally binding agreement. You’ll start making manageable payments, and creditors will no longer contact you about your financial affairs.