Get in Touch: (403) 232-6220

Your Next Chapter Starts Today – Debt Free and Strong

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

Nearly 50% of Canadians feel trapped by debt, and if you’re in Blackfalds, you’re not alone. If mounting bills or creditor calls have you feeling overwhelmed, BNA Debt Solutions is here to help. For 27 years, our Licensed Insolvency Trustees have helped Albertans overcome financial stress through government-regulated consumer proposals.

From Valley Ridge to Aspen Lakes, a consumer proposal can offer relief through one manageable monthly payment, reducing unsecured debt, stopping creditor calls, and helping you move forward without bankruptcy. Let’s talk for free and explore how much lighter life can feel.

A consumer proposal provides more positive benefits then you think and will turn common misconceptions into a feeling of relief.

Feeling overwhelmed by endless bills in Blackfalds? A consumer proposal merges unsecured debts into one manageable monthly payment, alleviating your financial burden. We tailor it to your household income and living expenses, ensuring you can breathe while addressing your debt.

Worried about creditor calls or legal actions? A consumer proposal in Blackfalds stops them instantly, restoring your peace of mind. Our Licensed Insolvency Trustees guide you with compassion, stopping legal action from unsecured creditors.

No one-size-fits-all solutions here. We create your consumer proposal based on your budget, making payments affordable and achievable. Our aim is to help you manage your finances without sacrificing what matters in Blackfalds.

A consumer proposal includes two credit counseling sessions to enhance your money management skills. With 27 years of experience behind us, we empower you to improve your credit report and plan for a debt-free future, prepared to thrive in Blackfalds with confidence.

A consumer proposal in Blackfalds is a plan that reduces unsecured debts through affordable monthly payments, guided by Licensed Insolvency Trustees. Imagine Lisa, a nurse from Blackfalds, who cut her $30,000 debt to $18,000, alleviating stress while retaining her home.

Could a Consumer Proposal Be Right for You?

You have unsecured debts like credit cards or loans up to $250,000, excluding your mortgage.

You can manage payments that fit your household income and living expenses.

You seek debt relief without losing assets through bankruptcy.

You’re experiencing creditor stress, but have income to repay part of the debt.

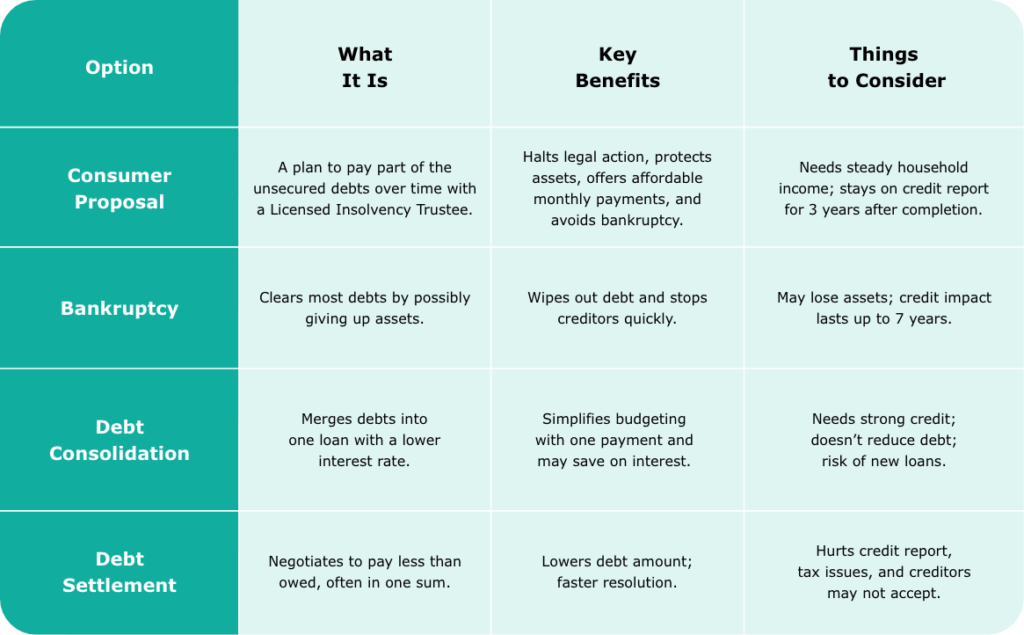

We’re BNA Debt Solutions, your Blackfalds neighbors. We’ll evaluate your financial situation and, if a consumer proposal is suitable, we’ll guide you. If not, we’ll find the best solution, like debt consolidation, all during a free consultation with our compassionate Licensed Insolvency Trustees.

Our Blackfalds team is here to map out a consumer proposal or other debt relief options that suit your life. No pressure, just a plan that works.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

Why consider a consumer proposal first?

In Blackfalds, where life is already tough, a consumer proposal allows you to keep your home and car while paying less to creditors. It fits your budget and living expenses, stops legal actions, and eases stress. With BNA Debt Solutions, our Licensed Insolvency Trustees guide you to debt relief with a plan that creditors accept, helping you rebuild your finances confidently.

Bankruptcy’s Hidden Costs

Picture yourself in Blackfalds, feeling trapped by unsecured debts that steal your sleep. Bankruptcy might seem like a quick fix, but it’s tough that your credit report suffers for up to seven years, and you might lose assets like your car or savings.

It’s a public filing that lingers, making future loans or rentals harder. At BNA Debt Solutions, we see your struggle and offer a better way. A consumer proposal delivers debt relief without the harsh consequences, keeping your finances on a hopeful path.

Consumer Proposal Advantages

Imagine a solution that feels like a fresh start in Blackfalds. A consumer proposal protects your home and car from unsecured creditor actions, halts creditor calls and legal action instantly, and establishes one affordable monthly payment customized to your household income and living expenses.

As Licensed Insolvency Trustees, BNA Debt Solutions crafts a proposal that creditors accept, avoiding bankruptcy’s burden. We guide you through the process with care, ensuring you repay what you can afford and rebuild your financial situation with confidence.

Overwhelmed by bills? We've walked that path and know the way out. A consumer proposal could be your fresh start. Let's explore it together in a free, no-pressure chat.

We know how heavy debt feels in Blackfalds, like a cloud that won’t lift. At BNA Debt Solutions, we’re here to be your support, not just another voice adding pressure. Our Licensed Insolvency Trustees guide you through a consumer proposal with care, making debt relief feel possible and real.

Step-by-Step Path:

Free Consultation: A warm, no-pressure, completely free-of-charge chat to understand your financial situation, debts, and living expenses.

Complete Financial Review: We dive into your unsecured debts and household income to find what works for you.

Proposal Design: Your Licensed Insolvency Trustee builds a proposal tailored to your budget and goals.

Submit & Negotiate: We handle creditor communications and present a fair plan for approval, so you don’t have to manage the stress alone.

Binding Agreement: Start one affordable monthly payment, freeze interest, and step toward a debt-free life.

For nearly 30 years, we’ve provided Albertans with compassionate, practical solutions to overcome debt challenges. We’re not just about numbers; we focus on your unique situation, delivering steady support to navigate tough times.

In Blackfalds, a consumer proposal simplifies your debt into one affordable monthly payment tailored to your budget. This strategic plan protects your home, preserves your income, and restores your peace of mind.

At BNA, we believe in honesty from the start. In Blackfalds, we lay out every option and cost clearly before you commit, with no hidden fees or gimmicks. Our straightforward approach ensures you understand the process, empowering you to make informed decisions.

Debt can feel overwhelming, but in Blackfalds, we turn stress into actionable strategies. A consumer proposal halts wage garnishments, stops creditor harassment, and sets you on a path to rebuild your credit. Our team walks beside you, offering steady guidance through every step of the process.

In Blackfalds, our focus is on you. We recommend only the solutions that best fit your unique situation, always recommending only what’s best for your situation. Our client-first approach means we listen carefully, understand your goals, and tailor our advice to meet your needs.

Our Licensed Insolvency Trustees in Blackfalds bring expertise with a human touch. We simplify complex legal processes, explaining each step in clear, everyday language you can trust. From filing your consumer proposal to guiding you through repayment, our team is here to answer your questions and ease your concerns.

Blackfalds thrives with its close-knit communities, such as Aspen Lakes, Valley Ridge, and Cottonwood Estates. However, an average debt of $85,000 can be overwhelming. Whether you live in Panorama Estates, Harvest Meadows, or nearby, BNA Debt Solutions offers tailored debt relief plans to suit your lifestyle.

Meet us in person, join us online, or give us a call. We make the process straightforward and judgment-free, helping Blackfalds residents achieve financial relief with solutions tailored to their needs.

Our Licensed Insolvency Trustees are more than just experts; they’re locals who understand the community. With over 230+ five-star reviews and a BBB A+ Rating, we’ve empowered countless Albertans to regain control of their finances. From consumer proposals to guidance on debt consolidation, we clarify your options with empathy and ensure you feel supported every step of the way.

Debt doesn't have to hold you back. Book a free consultation in Blackfalds or online, and let's find a consumer proposal or path that brings back your spark. There is no pressure; just care.

For nearly three decades, BNA Debt Solutions has stood by Albertans, offering clear, heartfelt solutions to reclaim financial control. Your trust drives us, and we’re proud to be Alberta’s trusted partner for effective debt relief.

Our Blackfalds team is ready to craft a consumer proposal or a debt relief plan that works for your unique financial situation, no push, just progress.

A consumer proposal is a legally binding process run by a Licensed Insolvency Trustee. It consolidates debt into one affordable payment, letting you keep assets like your home, unlike bankruptcy. In Blackfalds, it’s a practical way to manage debt with expert help.

A consumer proposal stays on your credit report for three years after completion, which is significantly less severe than bankruptcy, which remains for up to seven years, depending on the situation. During this time, it can help you start rebuilding credit when combined with healthy financial habits. In Blackfalds, our Licensed Insolvency Trustees guide you toward a stronger financial future.

A debt management plan, often offered by not-for-profit credit counselling agencies, may not include secured debts, such as mortgages or car loans. For a comprehensive solution in Blackfalds, a consumer proposal might be a better fit.

Only a Licensed Insolvency Trustee, licensed by the Office of the Superintendent of Bankruptcy, can file a consumer proposal. In Blackfalds, we handle the process, negotiating with creditors on your behalf to create an affordable debt relief plan.