Get in Touch: (403) 232-6220

Say Goodbye to Debt Stress, We’re Here to Help You Move Forward.

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

If you’re feeling overwhelmed by debt, take a deep breath—you’re not alone, and there’s a way forward. A consumer proposal can help you lower your payments, stop collection calls, and rebuild your financial future—without the stress of bankruptcy.

At BNA Debt Solutions, we’re more than just debt experts—we’re a family helping Albertans regain financial peace of mind for over 27 years. We know that asking for help can feel intimidating, but you deserve a solution that’s fair, stress-free, and built around your needs. Let’s take the first step together and help you move forward with confidence.

A consumer proposal provides more positive benefits then you think and will turn common misconceptions into a feeling of relief.

A Consumer Proposal can make paying off debt feel more manageable by letting you pay just a part of what you owe. It takes the pressure off those sky-high interest rates and helps you focus on getting back on track. With our help, you'll feel more in control and less stressed about your finances.

We know how draining those collection calls can be. A Consumer Proposal puts an end to them and stops wage garnishments, giving you the breathing room you deserve. With our support, you’ll finally feel a sense of control and relief without facing it all alone.

Getting your credit back on track doesn’t have to be stressful. You can start making regular payments and gradually see your credit score improve. We are here to help you make the right choices and prepare you for lasting financial stability.

A Consumer Proposal lets you tackle your debt without the fear of losing your home or car. With the help of licensed trustees, you can avoid the harsh impact of bankruptcy and keep your financial dignity intact. It’s all about finding a solution that helps you manage your debt while holding on to what’s truly important.

A consumer proposal is a formal agreement that allows individuals to manage their debt by paying creditors a portion of what is owed. This agreement is legally binding, providing a structured plan to settle debts without the need to declare bankruptcy.

In a consumer proposal, we make an offer to your creditors to pay back part of the debt over a set period of time. This extends the time you have to pay, which can make monthly payments more manageable. It’s a compassionate and respectful process that aims to reduce financial stress. By choosing this route, you can avoid the severe consequences that often come with bankruptcy.

For example, John had $40,000 in debt and a monthly income of $3,500. Instead of filing for bankruptcy, he worked with a Licensed Insolvency Trustee (LIT) to create a repayment plan. His LIT negotiated with creditors, and they agreed on a structured plan where John would pay $300 per month for 60 months (five years). This significantly reduced his overall debt while allowing him to keep his assets and rebuild his financial stability—without the lasting consequences of bankruptcy.

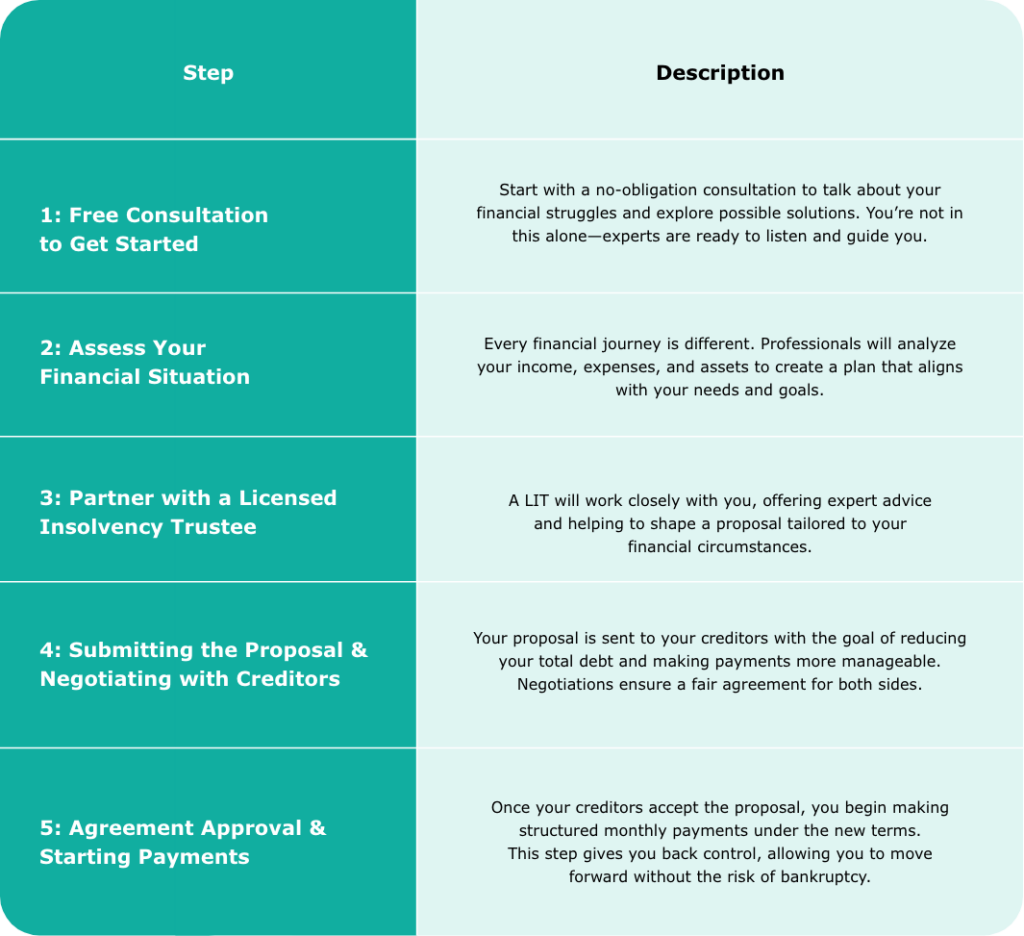

We know financial stress can be overwhelming. If you’re looking for a debt solution in Brooks, Alberta consider these simple steps for a fresh start.

Feeling stuck in debt? You're not alone—we’re here to help you find a way forward with clarity and confidence. Let’s talk, explore your options, and create a plan that works for you.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

No matter where you live in Brooks—West End, Eastbrook, Southshore, Uplands, Lakewood, or Sunnylea—we’re here to help you take control of your finances. At BNA Debt Solutions, we understand the stress that debt can bring, and we’re committed to providing guidance and solutions that make a real difference for Brooks and area residents.

We know that everyone’s situation is unique, and convenience matters. That’s why we offer flexible ways to connect—meet with us in person, chat over the phone, or even offer virtual meetings so you can get expert financial guidance without the hassle of commuting. No matter how you reach out, our Licensed Insolvency Trustees will walk you through your options with care and expertise, helping you move toward a brighter future.

We’re not here to sell, just here to listen. Let’s discuss how a consumer proposal can give you the relief you deserve.

In Brooks, Alberta, we’re all about helping you find a way out of debt that feels manageable and respectful. Instead of pushing bankruptcy, we focus on consumer proposals—a solution that lets you tackle your debt without losing everything you’ve worked for. With Licensed Insolvency Trustees (LITs) from BNA, guiding you every step of the way, you’ll feel supported, informed, and in control throughout the process.

Eligibility for a consumer proposal or bankruptcy depends on factors outlined in the Bankruptcy and Insolvency Act. Our team, including our Licensed Insolvency Trustees (LITs), is here to help determine the best solution for your situation. LITs provide expert advice and ensure the proposal is fair for you and your creditors.

LITs manage all communication and negotiations with creditors, reducing stress for you. As neutral, government-authorized professionals, they ensure every step is handled properly. When you work with us, you’ll receive personalized support and guidance tailored to your financial challenges, helping you move forward with confidence.

For over 27 years, BNA Debt Solutions has been helping residents in Brooks and the surrounding area find real financial relief. We understand how overwhelming debt can feel, and we’re committed to guiding you toward a solution that works—without pressure or unnecessary stress.

You don’t have to face this alone. Our Licensed Insolvency Trustees provide expert guidance with compassion, ensuring you have a clear path forward. We focus on what’s best for you, creating a supportive environment where you feel heard and empowered.

No two financial situations are the same, which is why we take the time to understand your unique challenges. Whether it’s reducing payments, extending repayment terms, or negotiating with creditors, we’ll help you create a plan that eases your burden and puts you back in control.

From day one, we believe in full transparency. There are no hidden fees and no fine print—just clear, honest advice that helps you make informed decisions. You’ll always know what to expect at every step of the process.

Debt stress can take a toll, but relief is closer than you think. We’ll help stop collection calls, end wage garnishments, and negotiate a repayment plan that fits your life. From your first consultation to the final step, BNA Debt Solutions will stand by your side, ensuring you feel confident about your financial future.

Navigating debt relief can feel overwhelming, but you don’t have to do it alone. Our Licensed Insolvency Trustees will be with you at every stage, offering trusted advice, clear solutions, and the reassurance you need to move forward with confidence.

Choosing a consumer proposal can be a much better option than bankruptcy when you’re trying to get back on your feet. It’s designed to make things easier for you, giving you some breathing room and flexibility when you need it most.

Keep what matters most: Keep your home, car, and other important belongings safe

Lower your payments: Lower monthly payments and more time to pay

Keep your credit score intact: Avoid the serious long-term damage to your credit score

Stay in the driver’s seat: Stay in control of your finances without being forced into liquidation

This process helps you move forward with confidence. If you want to learn more, set up an appointment with one of our trusted LITs today.

We understand how stressful debt can be, but you’re not alone. At BNA Debt Solutions, we’re here to support you with real solutions that bring relief and confidence. Let’s take the first step toward a future where you feel financially secure and in control.

For over 27 years, we’ve been walking alongside Albertans, helping them regain control of their finances with honesty and care. Your trust means everything to us, and we’re proud to be the team people turn to for real support, clear advice, and solutions that truly help.

You don’t have to figure this out alone. BNA Debt Solutions offers Free local initial consultations, giving you the chance to talk to a professional, in-person or virtually, about real solutions that fit your life. No pressure, just honest support to help you move forward with confidence.

Alternatives to consumer proposals include debt consolidation loans, debt management plans, credit counseling, debt settlement, and personal bankruptcy. Each option has its benefits and drawbacks. We can assist you in finding the best solution for your needs.

No, there are no upfront costs to start a consumer proposal. All fees are included in your monthly payments, making it easier for you to manage. Plus, your initial consultation is completely free, giving you a clear idea of the options available to you.

No, credit cards are included in the consumer proposal and will be closed. This helps prevent further debt accumulation. After completing the proposal, you can focus on rebuilding your credit to achieve long-term financial stability without the burden of credit cards.

Yes, self-employed individuals or those with irregular income can apply for a consumer proposal. We’ll work with you to create a personalized plan that takes into account your unique financial situation, ensuring it fits your income and lifestyle.

If your financial situation changes during the proposal, it’s important to contact your trustee immediately. They’ll assess your new situation and may adjust your payment plan or offer alternative solutions to keep you on track toward debt relief.