Get in Touch: (403) 232-6220

Leave Debt Behind – Your Fresh Start Is Just One Step Away

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

Financial challenges are a reality many face, but they don’t have to define your future. At BNA Debt Solutions, we’re committed to helping Fort McMurray residents find a path to financial stability. A consumer proposal provides a practical way to reduce debt and safeguard your assets, giving you the foundation for a more secure and stress-free tomorrow.

Your path to financial freedom begins with a free consultation. Our dedicated team will guide you through options like a consolidation loan or debt relief strategies that fit your unique needs. Let’s work together to create the financial future you deserve. Schedule your free consultation today and take the first step toward a new beginning!

Every unpaid bill, overdue loan, or missed payment can make you feel trapped, especially if you’re living in Fort McMurray and struggling to stay ahead. As debt grows, the burden can feel heavier, impacting your day-to-day life. Whenever you feel this weight, know that we’re here to support you.

Interest charges on your debt pile up quickly, turning a manageable balance into an overwhelming amount you struggle to afford. It’s an invisible thief that steals more of your hard-earned money each month. We want to help keep your money where it belongs—in your pocket.

Over-indebtedness can feel like a never-ending spiral. Creditors call, debts mount, and your options seem limited. We’re here to help guide you through this and find a way out of debt problems.

Debt, especially when it goes unresolved, can severely damage your credit. The impact lasts for years, affecting your ability to buy a home, get a car loan, or even land a job. Together, we can work on strengthening your financial future.

Our Licensed Insolvency Trustees (LITs) have helped countless Albertans, including residents of Fort McMurray, find relief from overwhelming debt. We’re honored to serve individuals working in industries tied to the Athabasca Oil Sands and members of the Woodland Cree, Chipewyan, and Métis communities. With a deep understanding of these communities’ unique challenges, our team provides personalized, compassionate assistance to help you regain financial stability and peace of mind.

A consumer proposal is a practical way to manage your debt without the stress of filing for bankruptcy. It allows you to pay a portion of what you owe while protecting your assets, giving you a fresh start. With the help of a licensed insolvency trustee, you can regain control and move toward financial freedom.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

Dealing with debt can be overwhelming, but we’re here to help. If you’re looking for a debt relief solution in Fort McMurray, Alberta, consider these simple steps:

Free Consultation: Let’s discuss your unique financial situation.

Personalized Plan: We’ll craft a consumer proposal tailored just for you.

Relief and Repayment: Regain control with affordable monthly payments.

Reach out to us today and start your journey to financial freedom with a consumer proposal.

Let us show you how we can simplify your financial situation and give you the fresh start you deserve.

Owe less than $250,000 in unsecured debts (excluding your mortgage).

Looking for a way to avoid bankruptcy and protect your assets?

Consumer proposals may help you restructure your debt and regain control.

Our Licensed Insolvency Trustees (LITs) are here to provide professional, compassionate guidance. We’re dedicated to helping you find the right solution for your unique financial situation.

Do Consumer Proposals Cover Secured or Unsecured Debts?

Consumer proposals primarily address unsecured debts like credit cards and personal loans. Secured debts, such as mortgages, are not included but can be managed separately.

For over 25 years, BNA Debt Solutions has supported Albertans struggling with debt. Our reputation is built on compassion, professionalism, and real results. We understand the weight of financial stress and are here to offer support every step of the way.

We know that every financial situation is different. That’s why we create consumer proposals that are tailored to your budget and needs. You deserve a solution that helps you breathe easier, and we’re here to make that happen—without judgment, just understanding.

At BNA Debt Solutions, honesty is key. You’ll never face hidden fees or surprises. We believe in clear communication so you can make confident decisions about your financial future. Our goal is simple: to help you find the best solution without the stress.

Say goodbye to creditor calls and constant worry. With a consumer proposal, you’ll regain control of your finances and create a clear path forward. This is more than just a quick fix—it’s a long-term solution that brings real relief.

Our priority is always to find the right solution for your unique situation, not to push products or services. Whether it’s a consumer proposal or another option, we’re committed to helping you find what works best for your future.

With BNA Debt Solutions, you’re never alone. Our Licensed Insolvency Trustees (LITs) are with you throughout the process, offering expertise and support at every turn. Together, we’ll find the path to a fresh start and a secure financial future.

We understand the weight of your financial problems and stress, and we’re here to offer you a way out. With a consumer proposal, you can regain control of your finances without the fear of losing everything. Here’s how a consumer proposal can help:

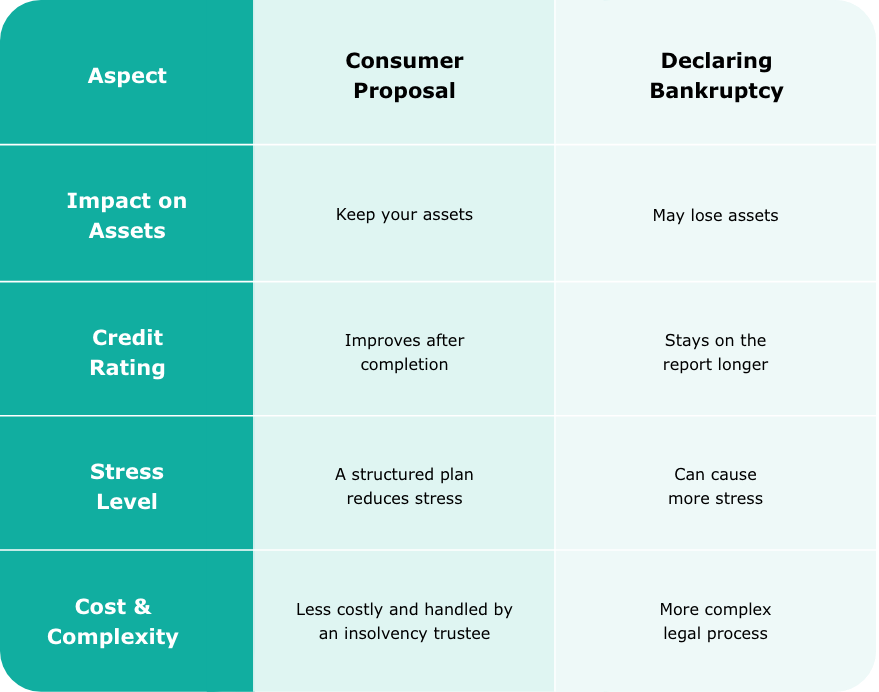

Consumer proposals offer a solution to manage debts without the harsh consequences of declaring bankruptcy. By negotiating a fair portion of what you owe, you can ease into repayment and avoid bankruptcy itself.

Our Licensed Insolvency Trustees guide you through every step, ensuring a respectful and understanding process. We recognize the courage it takes to seek help and honor your trust by crafting solutions tailored to your needs.

When dealing with creditors, a trained professional by your side can bring relief. Let us negotiate on your behalf, giving you the space to focus on your future. Fort McMurray offers local offices for convenient support, whether you’re right in the city or the surrounding area.

We care about your financial freedom. Don’t wait—contact our Fort McMurray team for your free consultation today. Call us at BNA Debt Solutions, email us, or fill out our contact form.

We’ve worked hard to earn the trust of Albertans for over 25 years. We’re proud to be recognized for our commitment to excellence and transparency.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

In addition to consumer proposals, options include debt consolidation and bankruptcy. Debt consolidation combines multiple debts into one loan, often with lower interest. Bankruptcy is a more drastic step that can affect credit long-term. We prioritize solutions that suit your financial situation and provide a fresh start.

Consumer proposals cover unsecured debts like credit cards, personal loans, and lines of credit. They do not include secured debts such as mortgages or car loans. This approach helps reduce debt while protecting essential assets like your home.

You may qualify if you owe $250,000 or less (excluding a mortgage). A licensed insolvency trustee evaluates your situation to determine eligibility. You must review your finances and consider a free consultation to explore your options.

Most consumer proposals are designed to be paid off in five years, but if your situation allows, sooner may be possible. Monthly payments are tailored to your income and budget, making financial recovery manageable over time.

A consumer proposal affects your credit, similar to a bankruptcy, appearing as R7 on your credit report. It remains for three years after completing payments. Despite this, it’s a structured way to alleviate debt pressures and can lead to improved financial management.

Yes, proposals can be adjusted if your financial situation changes. Early completion is also possible, especially if your income improves. We are committed to providing flexible debt relief solutions that adapt to your needs, aiding in your journey to financial stability.