Debt Doesn’t Have to Weigh You Down– Start Your Journey to Freedom

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

Debt can feel like a looming shadow—always there, weighing you down and making life harder than it should be. But don’t worry, you’ve got options, and BNA is here to help you find the best one. A consumer proposal is a way to pay back just part of what you owe and take the pressure off by giving you more time to settle your debts. It’s about finding relief without losing what matters most to you.

At BNA Debt Solutions, we’ve been in your corner for over 27 years. We’re a family-owned business, and we know how tough this can feel. We’re here to help you avoid the burden of bankruptcy and find a solution that fits your life and your needs. Let’s work together to get you back on track.

A consumer proposal provides more positive benefits then you think and will turn common misconceptions into a feeling of relief.

Interest on credit card debts adds up fast, making it hard to get ahead. A consumer proposal stops it immediately, so every dollar goes toward what you owe—not just interest. Lower payments make it easier to take control.

Dealing with constant collection calls and the fear of legal action can feel like too much to handle. With a consumer proposal, you’ll have a clear plan for your debt payments, allowing you to breathe easily without worrying about constant creditor pressure. You can finally focus on rebuilding your finances.

When you start managing your debt responsibly, your credit score begins to recover. A consumer proposal gives you a clear, doable plan to pay back what you owe, which helps your credit report improve over time. The sooner you start, the faster you’ll see results.

When you’re dealing with debt, holding onto the things that matter most—like your home or car—can feel like a lifeline. The good news is that a consumer proposal helps you do just that. Unlike bankruptcy, which might mean selling off assets, it lets you keep what’s important while you work through your debt.

A consumer proposal is an agreement governed by the Bankruptcy and Insolvency Act, which allows you to pay back a portion of your debt over time without the harsh consequences of personal bankruptcy. Think of it as a fresh start that lets you keep what matters most.

A Better Alternative to Bankruptcy

With a consumer proposal, you work out a plan to pay back a portion of your debt, usually over five years. Unlike bankruptcy, you get to keep your assets—like your home or car—while making one manageable payment instead of juggling multiple creditors. For many people, it’s a way to ease the stress and take back control of their finances.

How a Consumer Proposal Protects You

Bankruptcy can mean losing assets and taking a big hit to your credit score, which can affect your future for years. A consumer proposal, on the other hand, protects your assets and gives you a chance to rebuild your finances without the same level of damage to your credit. It’s a way to tackle your debt while keeping your financial health intact.

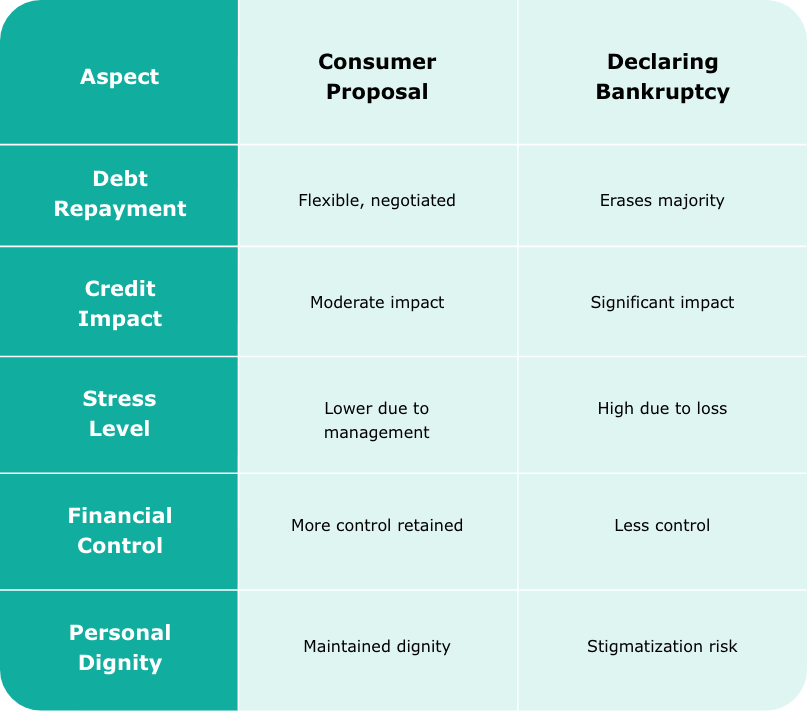

If you’re considering debt relief options, it’s important to understand how a consumer proposal compares to declaring bankruptcy. Each has its benefits, but a consumer proposal often provides a balance between reducing debt and maintaining financial stability.

Debt can be tough, and it’s easy to feel like you’re carrying it alone. But you don’t have to. At BNA Debt Solutions, we’re here to listen, understand, and help you find a way forward, without pressure or judgment. Let’s figure this out together.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

At BNA Debt Solutions, we’re here for you no matter where you are in Fort Saskatchewan. From Westpark and Pineview to Southfort, Sherridon, and Windsor Pointe, we’re ready to help you get back on track.

Life gets busy, and dealing with debt can feel overwhelming. That’s why we make it easy to reach us—meet in person, chat over the phone, or have a video call from home. However you choose to connect, our Licensed Insolvency Trustees (LITs) are here to listen, support you, and help you take control of your finances with a plan that works for you.

In Fort Saskatchewan, Alberta, we know how overwhelming debt can feel, and we’re here to help you find a way forward—one that’s fair, manageable, and respects everything you’ve worked for.

Instead of rushing into bankruptcy, we focus on debt consolidation loans or more customized solutions such as consumer proposals. With BNA’s Licensed Insolvency Trustees by your side, you’ll have patient, professional guidance every step of the way so you can move toward a debt-free future with confidence.

Debt doesn’t have to control your life. At BNA Debt Solutions, we help you find real, manageable solutions so you can move forward with confidence. Let’s start your journey to financial freedom today.

Facing debt is exhausting, and not knowing your options only makes it harder. But with a consumer proposal, you’ll settle your debt with unsecured creditors, paying only a portion of what you owe, while keeping your assets intact. Here’s how we make the process simple and stress-free.

Know Where You Stand: List all your debts—credit cards, loans, and taxes—alongside your income and expenses. This gives us a clear starting point to create a plan that fits your budget.

Pick a Plan That Works: Next, we’ll design a manageable repayment plan, usually over five years, with one simple monthly payment that works for you.

We Handle Everything: Once your plan is set, we handle all the paperwork, negotiate with creditors, and take care of the details—so you don’t have to. That means no more collection calls or legal threats.

Stay on Track: Your job is to keep up with your payments while we support you along the way. Consistency brings you closer to a debt-free future.

Once your proposal is in place, you’ll feel the relief right away—no more creditor calls, lawsuits, or wage garnishments. At BNA Debt Solutions, we’ve helped thousands of Albertans take back control of their finances, earning 200+ positive reviews along the way. When you complete your proposal, your remaining unsecured debt is cleared, giving you the fresh start you deserve.

Choosing between a consumer proposal and declaring bankruptcy can feel like a lot to handle. Both options help you deal with debt, but they work differently and can affect your finances and future in big ways. We get it—this isn’t an easy decision, and that’s why we’re here to help you figure out what’s best for you.

If you owe less than $250,000 (not counting your mortgage), a consumer proposal could be an option.

In a consumer proposal, you agree to pay back part of what you owe, usually over up to five years.

A consumer proposal lets you keep things like your home or car, and your payments are easier to manage.

Your financial situation plays a crucial role in determining whether a consumer proposal or bankruptcy is the right solution for you. We recommend reaching out for a consultation to explore your options. Our team at BNA Debt Solutions is ready to provide support and guidance.

For more than 27 years, we’ve been helping people in Fort Saskatchewan tackle their debt challenges, offering trusted solutions that bring real relief to you.

Everyone’s situation is different, so we create solutions that fit your unique needs. We’ll work closely with you to come up with a plan that matches what you can afford, making sure it’s practical and doable.

You’ll always get straightforward, honest advice—no jargon, just real solutions to help you take control of your debt with confidence.

Those stressful creditor calls stop almost immediately—we make sure of it. But it’s not just about quick relief; we’re here to help you create a plan that sets you up for long-term financial peace.

Our only focus is finding the best debt relief solution for you—no upselling, no pressure, just honest support to help you move forward.

Our licensed trustees are here to guide you every step of the way, from your first chat to the finish line. In Fort Saskatchewan, our team makes sure you get the support and advice you need, so you can tackle your financial challenges with confidence.

A consumer proposal lets you settle your debts by paying back only a portion of what you owe, often with lower monthly payments. Unlike bankruptcy, it helps you keep important assets like your home and car, giving you peace of mind while you rebuild financially.

Safeguard valuable assets like your home and vehicle

Enjoy lower, more manageable payments with extended repayment time

Protect your credit from the severe long-term effects of bankruptcy

Maintain control over your finances, avoiding forced liquidation

Benefit from more flexible terms and fewer penalties compared to bankruptcy

We understand how stressful debt can be, but you don’t have to go through it alone. At BNA Debt Solutions, we’re here to listen, support, and guide you toward a debt-free future. Let’s take the first step together, at your pace, on your terms.

For over 27 years, we’ve been helping Albertans take control of their finances with honesty and care. Earning your trust means everything to us, and we’re proud to be known for our support, transparency, and dedication to real solutions.

Take the first step today—reach out to BNA Debt Solutions for a free consultation, online or in person, and discover debt relief options designed just for you, with no risk or pressure.

Yes, once your consumer proposal is filed, all wage garnishments and collection actions stop, including those from the Canada Revenue Agency (CRA). Creditors can no longer deduct money from your paycheck, giving you financial relief.

If you miss three payments, your consumer proposal may be annulled, and creditors can pursue full debt collection. If you’re struggling, contact us immediately to discuss adjusting your payment plan and keeping your debt relief on track.

Yes, you can pay off your consumer proposal early in a lump sum or by making extra payments. This helps you rebuild your credit rating faster and achieve financial freedom sooner. There are no penalties for early repayment. Many debt relief agencies encourage early repayment as a way to speed up your recovery and financial stability.

A consumer proposal only affects the person filing it. Your spouse’s credit score remains unchanged unless they co-signed debts. However, joint loans, mortgages, or credit cards may still impact shared financial plans.

While existing credit cards are usually closed, you can apply for a secured credit card to rebuild your credit rating. Some lenders offer credit options after a few on-time proposal payments. Responsible usage helps improve your credit score over time.