Get in Touch: (403) 232-6220

Leave Debt Behind – Your Fresh Start Is Just One Step Away

100% Free Consultation – No Upfront Costs, No Obligation, Just Peace of Mind.

At BNA Debt Solutions, we’ve spent over 27 years helping people regain control with compassion and customized solutions.

A consumer proposal could be the fresh start you need. It allows you to pay back only a portion of what you owe while keeping your assets safe and lowering monthly payments. With BNA, you’re not just a case number but a person with unique needs. Our Licensed Insolvency Trustees are here to guide you toward a brighter financial future, offering the support and options you need for a fresh start.

A consumer proposal provides more positive benefits then you think and will turn common misconceptions into a feeling of relief.

A consumer proposal provides immediate relief by halting creditor calls and reducing monthly payments, turning debt into a manageable, judgment-free plan.

A consumer proposal provides a structured path forward, offering you the time and space to rebuild and focus on what matters most.

Addressing debt today can make financial freedom a reality sooner. You can create opportunities for a brighter future with the right plan, like a consumer proposal.

Debt can impact your credit score over time, limiting financial opportunities. A consumer proposal helps you take control, manage debt responsibly, and protect your credit for future needs.

A Debt Solution for Those Who Want to Avoid Bankruptcy

A consumer proposal is not just a financial agreement—it’s your lifeline out of overwhelming debt. With the help of a Licensed Insolvency Trustee, you can reduce your total debt by up to 80% and repay it over manageable installments, all while protecting your assets.

What makes a consumer proposal genuinely empowering is that you can keep your assets—your home, your car, the things you’ve worked hard for. It’s a practical and compassionate alternative to declaring bankruptcy, offering the chance to take control of your finances without losing everything. For many in Grande Prairie, it’s the first step toward rebuilding not just a budget but a life with stability and hope.

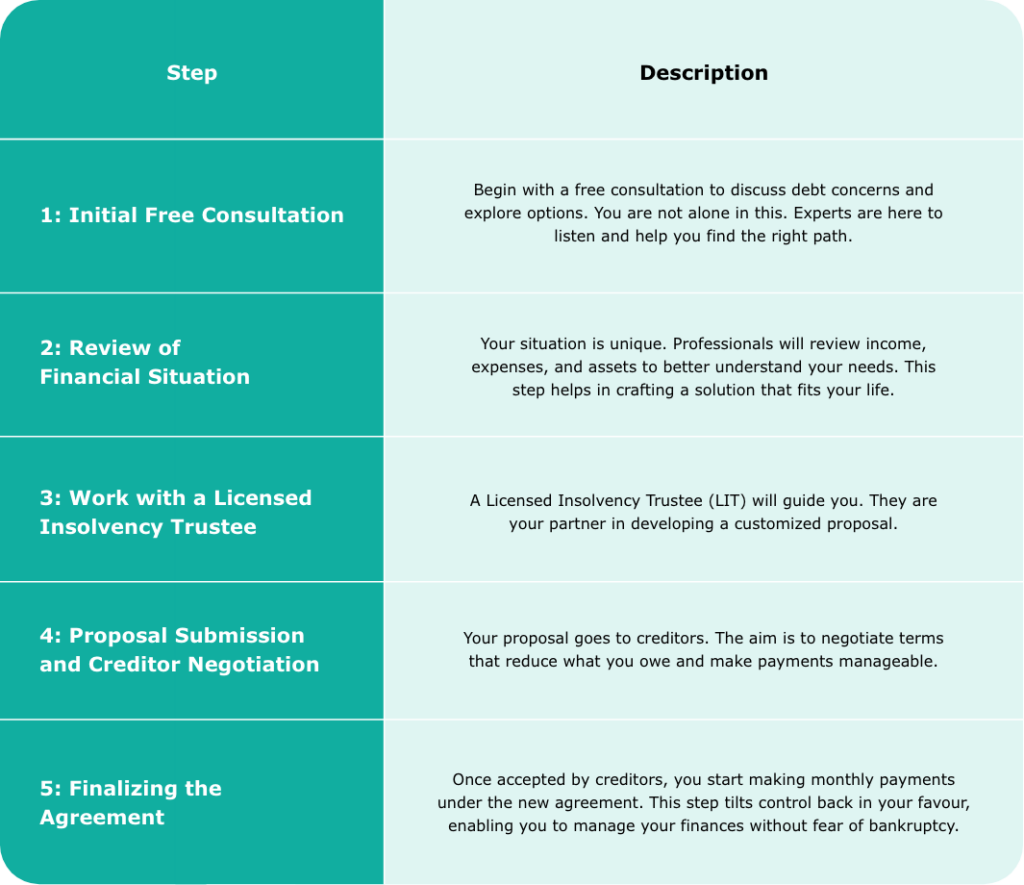

How a Consumer Proposal Can Help You Avoid Bankruptcy

A consumer proposal offers a way out, allowing you to protect what matters most while gaining legal protection from creditors. It’s a chance to avoid the harsh consequences of bankruptcy and start building a stable, brighter future on your terms.

Speak with one of our experts to learn how a consumer proposal can help you reduce your debt and regain peace of mind.

Note: This is an average repayment, however, each person’s circumstances will impact their repayment

At BNA Debt Solutions, we’re proud to support people all across Grande Prairie and nearby areas like Clairmont, Beaverlodge, and Sexsmith. Whether you’re in the heart of Downtown Grande Prairie or one of the surrounding neighbourhoods, we’re here to help you find the right path to financial relief.

We know life gets busy, so we’ve made it easy to connect with us in a way that works for you. You can meet with us in person, chat over the phone, or even have a video call from the comfort of your home. Whatever option you choose, our Licensed Insolvency Trustees are ready to guide you every step of the way and help you take back control of your finances.

A Licensed Insolvency Trustee (LIT) is here to guide you every step of the way. Licensed by the federal government, LITs act as neutral mediators, ensuring fairness between you and your creditors.

At BNA Debt Solutions, we believe in walking this journey with you, explaining the process clearly, negotiating on your behalf, and helping you regain control. Start your path to relief with a free consultation today.

Let us show you how we can simplify your financial situation and give you the fresh start you deserve.

Qualifying for a consumer proposal in Grande Prairie is easier than you might think. If you have unsecured debts (not including your mortgage) totalling under $250,000 and at least $1,000 in unsecured debt, you’re already on the right track.

You’ll also need to show you can manage smaller, more affordable payments. If your debts are more than you can handle, or your assets don’t cover what you owe, you likely qualify. As a Canadian resident or property owner, this flexible and supportive debt relief option is available to you.

You don’t have to figure this out on your own. At BNA Debt Solutions, we truly understand how overwhelming this process can feel. Our Licensed Insolvency Trustees (LITs) will sit with you, listen to your story, and help you explore the best solution.

BNA Debt Solutions has over 27 years of experience in Alberta, helping residents tackle their financial challenges with professionalism and care. This long-standing presence has built trust with the community.

Each consumer proposal is tailored to fit the individual's budget, ensuring a realistic and manageable plan. This personal approach helps clients regain control over their finances.

Clients receive honest advice from BNA, clear communication, and no unexpected charges. Transparency is key to our service, ensuring clients feel confident in their decisions.

Stopping creditor calls and easing monthly payments provides immediate relief, setting clients on a path to financial freedom and peace of mind.

The focus is finding the best debt solution for each client without pressure to choose unnecessary services.

Licensed Insolvency Trustees are involved throughout the process, providing knowledgeable support and ensuring trustworthy, effective debt relief solutions.

Choosing a consumer proposal can significantly ease your financial burden compared to declaring bankruptcy. It offers a more manageable approach and flexibility.

Protect assets: Keep your home and car safe.

Lower payments: Enjoy reduced monthly payments with extended repayment periods.

Avoid severe impacts: Sidestep the harsh credit impacts associated with bankruptcy.

Maintain control: Stay in charge of your finances without forced asset liquidation.

This approach allows you to take positive steps towards financial recovery. For more information, schedule an appointment with one of our trusted LITs.

We know how heavy the debt burden can feel, but BNA Debt Solutions is here to help you find peace and financial freedom. You don't have to face this alone—let's take the first step toward a brighter, debt-free future together.

We’ve worked hard to earn the trust of Albertans for over 27 years. We’re proud to be recognized for our commitment to excellence and transparency.

Take action now—contact BNA Debt Solutions for a free consultation, virtual or in-person, and explore risk-free debt relief options tailored to your needs.

Debt consolidation combines multiple debts into one payment, often with lower interest charges. It’s a good option for simplifying repayments and saving money over time.

A consumer proposal allows you to repay part of your debt without losing assets, unlike bankruptcy. It also provides legal protection from creditors and helps avoid severe credit impacts.

Yes, credit counselling offers tailored budgeting advice and debt solutions. It helps you explore alternatives like payment plans or debt settlement to regain control over finances.

Defaulting can lead to garnishment, liens, or repossession by creditors. To avoid severe consequences, speak to debt experts to explore options like forbearance, debt settlement, or filing a consumer proposal.

We offer a free consultation today to review your financial situation. Our Licensed Insolvency Trustees guide you toward good options for debt relief without hidden fees.

Yes, other options include consumer proposals, credit counselling, or working with a Licensed Insolvency Trustee to find manageable solutions. These can help reduce arrears and interest charges effectively.

Whether you’re managing debt in Crystal Lake Estates or trying to avoid bankruptcy in Pinnacle Ridge, a consumer proposal offers legal protection from creditors and a manageable repayment plan. This solution is designed to help communities like South Patterson Place and Highland Park regain financial stability.