Debt isn’t just about numbers—it’s about the weight it places on your life.

If you’ve found yourself here, take a moment to breathe. It means you’re already taking the first step toward relief, and that’s no small feat. At BNA Debt Solutions, we don’t just focus on fixing finances; we’re here to help you reclaim peace of mind.

We understand the doubts, the sleepless nights, and the fear of judgment—but let us assure you: you’re not alone. Whether you’re protecting your home, rebuilding after a setback, or simply trying to find clarity, you’ve come to the right place. Let us guide you to a debt solution that not only works but feels right for you.

Understanding Debt Relief Options

What Is a Consumer Proposal?

A consumer proposal isn’t just about reducing debt; it’s about taking back control of your life. We’ll negotiate a manageable plan with your creditors, so you can breathe easier knowing you’ll keep what matters most, like your home or car. This isn’t just a financial decision; it’s your chance to step into a future free of constant financial worry.

Our clients find this option less stressful, as it allows them to keep their assets and stop collection calls. Consumer proposals typically have a lesser impact on credit ratings compared to a bankruptcy. For many, it offers control over finances without declaring bankruptcy.

What Is Bankruptcy?

While bankruptcy might seem daunting, for many of our clients, it’s a necessary step toward rebuilding their lives. Though it involves sacrifices like giving up certain assets or tax refunds, it also offers immediate relief from unmanageable debt. Our team works closely with clients during this process, offering guidance and compassion every step of the way.

For those who choose this path, bankruptcy provides a chance to reset and move forward with a fresh start. At BNA Debt Solutions, we ensure our clients understand their responsibilities, such as monthly income reporting and attending credit counseling sessions, so they feel confident in their decisions. While it will have an impact on your credit score, we help clients focus on the long-term benefits of financial freedom and the opportunity to rebuild with a clean slate.

Consumer Proposal Vs. Bankruptcy: Overview

Deciding between a consumer proposal and bankruptcy can feel overwhelming, but understanding the differences makes it easier to choose the best fit for your situation. Here’s a quick breakdown to help you navigate your options with confidence.

Credit counseling sessions are required for both consumer proposals and bankruptcies, helping individuals understand their financial situation and how to manage debt moving forward.

Key Differences Between Consumer Proposal and Bankruptcy

Eligibility

To file a consumer proposal, individuals must have unsecured debts under $250,000 (excluding their mortgage). Personal bankruptcy, governed by the Bankruptcy and Insolvency Act 65.13 (1), does not have this debt limit, making it accessible to those with higher debt.

Cost Structure

Consumer proposals usually involve arranging monthly payments that fit your budget. Bankruptcy can involve additional costs like surplus income payments based on household income, which may vary depending on income fluctuations.

Asset Protection

A consumer proposal allows individuals to keep all their assets. Bankruptcy may require surrendering some assets to help repay debts, which can impact one’s financial situation and lifestyle.

Duration

Consumer proposals typically last up to five years, providing a gradual approach to resolving debt. Personal bankruptcy lasts 9 to 21 months for first-time bankruptcies, affecting one’s financial obligations in a shorter time frame.

Credit Impact

While both affect credit scores, a consumer proposal remains on a credit report for three years after completion or a maximum of six years. Bankruptcy affects one’s credit history for six to seven years after discharge, which can hinder financial recovery.

Future Financial Effects

Filing a consumer proposal helps individuals manage their debts over time and may allow for more predictable financial planning. In contrast, bankruptcy can have more immediate, significant effects on credit and future economic prospects.

How To Choose Between A Consumer Proposal And Bankruptcy

Feeling stuck between options? That’s completely normal. The right choice depends on your unique situation, and we’re here to help you figure it out—without judgment, at your pace. Both offer routes to manage secured debts and other financial obligations but differ significantly in process and outcomes.

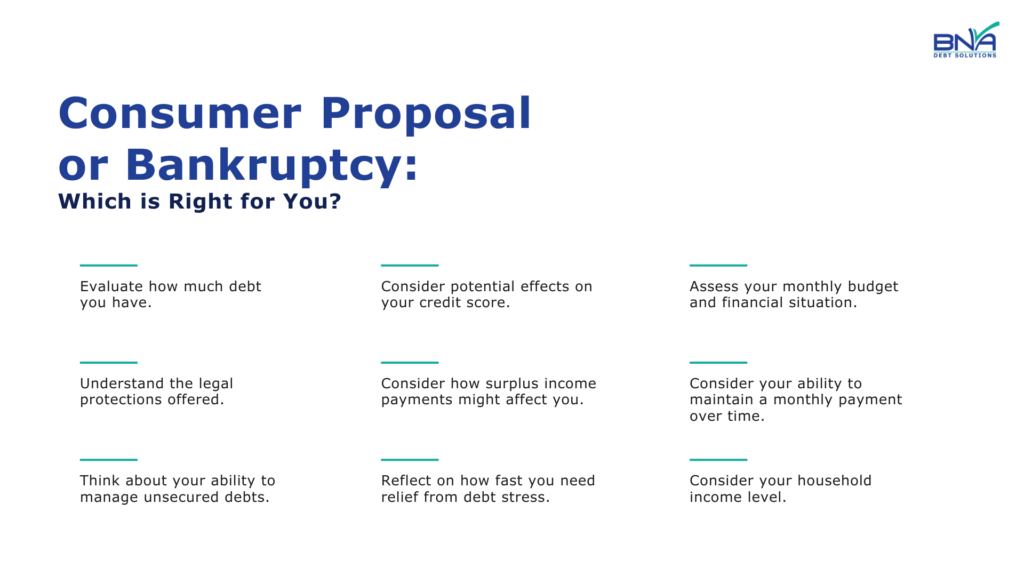

Key Factors to Consider When Deciding:

- Evaluate how much debt you have.

- Consider potential effects on your credit score.

- Assess your monthly budget and financial situation.

- Understand the legal protections offered.

- Consider how surplus income payments might affect you.

- Consider your ability to maintain a monthly payment over time.

- Think about your ability to manage unsecured debts.

- Reflect on how fast you need relief from debt stress.

- Consider your household income level.

What to Expect: Monthly Payments, Legal Protections, and Surplus Income

In a consumer proposal, you typically make fixed monthly payments over an extended period, which are negotiated based on your financial situation. These payments are generally lower than you would pay in bankruptcy, where surplus income payments might come into play.

Surplus income is calculated based on your average monthly income and household income. Filing for bankruptcy often provides immediate legal protections, stopping collection calls and wage garnishments. Bankruptcy may require variable payments; if your income increases, so will your monthly payments.

How Consumer Proposals Affect Your Credit Report and Credit Score

While debt relief options like consumer proposals and bankruptcy affect your credit, they also offer a clean slate. A consumer proposal allows you to rebuild sooner, and even with bankruptcy, there’s a path to regaining your financial health—with the right guidance. A consumer proposal stays on your credit report for three years after completion, while bankruptcy remains for six to seven years after discharge.

This means that a consumer proposal or debt settlement might allow for quicker financial recovery and rebuilding of credit history. A consumer proposal results in an varied credit rating on your credit report for the duration of six years, whereas filing for bankruptcy leads to an R9 rating—the lowest and most severe rating for six to seven years after your discharge. Considering impacts is crucial when deciding on the right path for debt relief. these

Rebuilding Credit After Debt Relief

Rebuilding your credit is the next step toward financial freedom—and it’s more achievable than you think. At BNA Debt Solutions, we’ll equip you with the tools and knowledge to regain confidence in your financial decisions, one step at a time. We will cover these topics in one of the counselling sessions during your consumer proposal or bankruptcy.

How BNA Debt Solutions Supports Clients

We understand that rebuilding credit can feel overwhelming. That’s why at BNA Debt Solutions, we provide clients with financial education and resources to guide them through this process. Our personalised approach ensures you know how to deal with your financial situation.

For example, one of our clients, Kristy, worked with us during credit counselling sessions to develop a clear plan for managing her tax debt. With our personalized support, she rebuilt her confidence and regained control of her financial future. We emphasize privacy and flexibility, offering these same resources to help you take charge of your finances with confidence.

Frequently Asked Questions

How does Consumer Proposal and Bankruptcy impact the financial future?

When considering a consumer proposal, it allows you to pay part of what you owe, typically leaving more room to rebuild your financial future. Bankruptcy, on the other hand, damages credit more severely than a consumer proposal.

What is unsecured debt, and why does it matter in debt solutions?

Unsecured debt includes things like credit card balances, personal loans, or even a car loan, which is not backed by collateral. These debts often accumulate quickly and require strategic management. Because they can build up rapidly, unsecured debt is often a key focus in debt solutions. Understanding these obligations helps you determine the best way to manage them, whether through a consumer proposal or bankruptcy.

What is an informal proposal?

An informal proposal is an agreement you negotiate directly with creditors without involving the formal legal process. While this can sometimes provide a less structured way to manage debt, it lacks the legal protection of formal options like a consumer proposal. It’s essential to weigh the benefits of both approaches before making a decision.

When is a consumer proposal better than bankruptcy?

A consumer proposal might be a better choice if you want to retain certain assets, such as your home or vehicle, or prefer to reduce the impact on your credit report. It can also be the better option for you if you want manageable monthly payments with the certainty of the outcome.

What happens to my tax refund if I file for bankruptcy or a consumer proposal?

If you file for bankruptcy, your tax refunds are typically considered part of your estate and may be forfeited. In contrast, with a consumer proposal, you often retain more control over your refunds. It’s important to discuss these details with your Licensed Insolvency Trustee to understand how they might affect your financial situation.

What occurs after your filing is complete?

Once your negotiated settlement process is complete, you can begin rebuilding your credit and financial stability. For bankruptcy, this may involve following a structured recovery plan. A consumer proposal often allows you to start this process sooner, as it generally has a shorter-term impact on your credit. The goal is to help you move forward on the path to financial freedom.

Seeking Professional Guidance for Debt Relief

We understand that navigating debt relief can be emotionally and financially challenging, but you don’t have to face it alone. That’s why consulting a Licensed Insolvency Trustee is crucial. They offer personalized advice tailored to your financial situation. Our team at BNA Debt Solutions provides expertise in both consumer proposals and bankruptcy proceedings, helping you choose the best option in Alberta.

A consumer proposal allows you to repay a portion of your debt over time and is often more sustainable and less intrusive than bankruptcy. Our approach focuses on reducing financial stress while maintaining your dignity. We believe in offering solutions that align with your personal and financial goals.

Beware of scams promising quick fixes. Unregulated debt advisors may charge unnecessary fees and provide unauthorized services. Trust only licensed professionals who can guide you through this process safely; as Licensed Insolvency Trustees are the only licensed professionals in Canada that can legally file a consumer proposal or a bankruptcy.

Our goal is to empower you with the confidence to manage your debt with the right debt solution.

Take the first step toward a stress-free future today. Schedule a confidential, no-pressure consultation, and let’s explore your options together. You don’t have to face this alone. We’re here to help.