Life’s too short for debt stress – let’s get you a real plan.

Alberta’s trusted Division 1 Proposal solution

Division I proposal

When the numbers are significant, the plan has to be strategic

Maybe the income’s decent. Maybe you’ve built assets. But cash flow is tight, interest is relentless, and every month feels like sand slipping through your fingers. That’s more common than people admit. When balances are over the consumer proposal limit or the situation is complex, a Division I Proposal is the safest way to renegotiate debt while protecting what you’ve worked hard to build.

It’s a formal process under the Bankruptcy and Insolvency Act that can pause most collections while we negotiate with your unsecured creditors for an agreement you can maintain.

What to expect

Relief you can count on

The calls slow, and wage garnishments stop

Once your proposal is filed, the Stay of Proceedings takes effect. Wage garnishments stop right away, while collection calls and other actions begin to ease as creditors are notified. Creditors should communicate with us – not you – but it may take a little time for that process to fully settle.

One payment you can live with

We combine your eligible unsecured balances into one payment aligned with your monthly income. No guesswork. Clear numbers that work, payments you can truly afford.

You keep control of what matters

A Division I Proposal helps you restructure personal unsecured debts – not liquidate your life. In many cases, you can keep your primary residence and continue operating a viable business while staying current on secured payments. Our trustees will help you understand what applies to your situation and how to protect what matters most.

A plan you can follow, not just temporary quiet

A Division 1 Proposal isn’t a stall tactic; it’s a debt solution with a clear start, middle, and end. Supported by proper procedures, votes, and court approval.

What our clients say

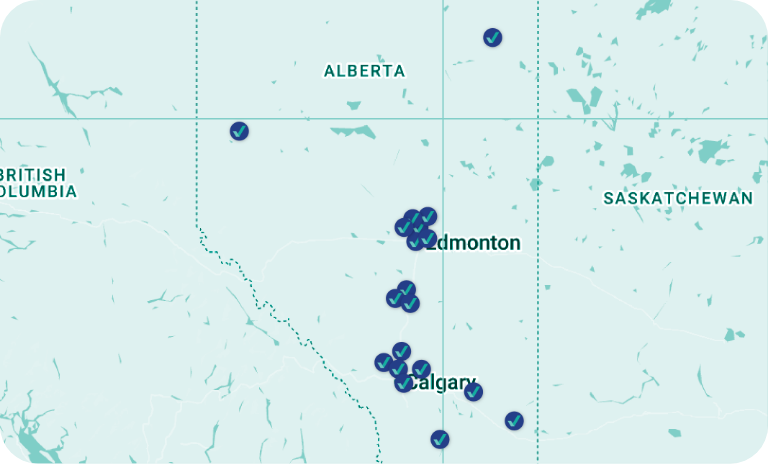

From first call to final step, 27+ years at your side

Thousands of Albertans have left debt behind with BNA. Here’s what some of them have to say:

If you are in a position where you need to find a solution out of debt, reach out to BNA for more information. There is no commitment to find out what options are available. I was embarrassed and uncomfortable to share the details of my experience but Sammie immediately put me at ease. She is compassionate, knowledgeable, flexible and an amazing problem solver. She covered all options available to me at my convenience, she passed no judgment, and I felt no pressure to commit. Together we settled on an option that worked best for me. It is never a winning situation to be in a position where you need to dig yourself out of a hole you created but I can finally see a light at the end of the tunnel, thanks to the team at BNA.

You walk in anxious and heavy, that awful burning in the pit of your stomach that comes with debt; feelings of shame, uselessness, irresponsibility. But then you talk to a representative like Simmie, and the weight of the burden begins to melt away. She’s there for you, she talks you through many options, she answers each and every one of your questions with clarity and compassion. Not only does she want to help, she’s trained and licensed to do so. There is work involved for you in this collaborative process, papers and numbers and lists but in the end you are presented with a very feasible, simple plan that allows you to breathe, to engage with your life and your finances in a measured way. I cannot thank Simmie and BNS enough for their empathy, quick turnaround, and straightforward processes.

Unfortunately ran into a sticky financial situation and was referred to BNA Debt Solutions through a debt counselling service. Have had a few meetings and they were always very helpful, kind and understanding. They made my consumer proposal very easy to understand and walked me through it all to ensure I was comfortable with the documents before we took any action. If you’re stressing out about financials, there is help available and I wish I would have reached out earlier. BNA is a great option!

I’ve got myself in very ugly financial situation. It was so stressful that I thought my life is over. It had very big impact on my mental and physical health. When I found out about BNA and their business it was just thin hope that maybe I would find some help. My first appointment was with Simmie Pandher in the office of BNA. After I presented my situation and my worries, Simmie has shown an enthusiastic interest to understand , assist and help me. She sounds like an angel when she said to me that I came to right place where they will find right solution for me. She told me that all my worries ,sleepless night and other concerns will be over. Now because of professional dedication and knowledge of Simmie and Andy Wong and their all team I am back to life again. THANK YOU!

Bad things happen to good people, especially in times of economic and employment uncertainty.

From the very beginning, from my first phone call, BNA Solutions has treated me with respect, empathy and complete professionalism.

The staff were very thorough, knowledgeable and prompt with all my interactions. All options were explained to me and I felt there was hope rather than darkness and despair.

Have used BNA Debt Solutions twice. Once for credit card debt and another regarding a business failure. Both times very empathetic to my situation. I felt I had someone in my corner when it came to dealing with institutions that were aggressive and not empathetic to our situation. Would recommend them infact I have sent three other individuals that had financial challenges and they were grateful that I recommended such a strong team of advocates for their situations.

About division I proposals

So… what exactly is a Division I Proposal?

“Division I Proposal” and “Division 1 Proposal” refer to the same process under Canada’s Bankruptcy and Insolvency Act. Think of it as a court-supervised agreement with your unsecured creditors. With your LIT, you agree to repay a portion of the money owed over a specific period (often 1–5 years, or longer if justified) or through a lump sum. Creditors vote on it. If it passes and the court approves, it becomes legally binding. You make payments directly to us; we distribute the funds. Complete the plan, and the unpaid, eligible portion of the unsecured debts included in your proposal is legally discharged.

Who can file (individuals & businesses) and when a consumer proposal isn’t enough.

- Individuals with debts exceeding $250,000 (including secured and unsecured debt, but excluding the mortgage on a primary residence). For clarity: this threshold also includes car loans and mortgages on rental or vacation properties.

- If a previous consumer proposal was annulled or if there is new debt, a Division I Proposal is typically necessary.

- Businesses that need to restructure without closing their doors require a proper corporate proposal.

- Under $250k but need more than 5 years? We’ll go over options. Sometimes Division I works when a longer timeline is necessary.

- Situations where protection is needed ASAP might call for a notice of intention, while we finalize terms.

If your situation involves less than $250k and five years will work, we’ll discuss a consumer proposal. If not, a Division I Proposal is probably the better option.

the steps

The easy path to debt relief, designed around your life

Ready for a fresh start

Curious what creditors might accept?

Let’s find out.

Let’s turn your numbers into a plan you can manage. Talk privately with a Licensed Insolvency Trustee about a Division I Proposal or a Consumer Proposal, whichever is more appropriate.

Creditor support

Why creditors usually support well-organized Division I Proposals

We build offers informed by experience

With over 27 years of files behind us, we understand what tends to make sense to creditors. We don’t promise outcomes or lobby votes, we structure terms that are clear, affordable, and easy to assess.

We base our beliefs on facts, not hope

The litmus test: unsecured creditors should receive a better return than in bankruptcy. When the offer meets that standard, favourable votes should follow.

We become more specific when it helps

If the file requires specific terms, such as a commitment to ongoing tax compliance, we’ll add them. A small but important difference can sway a vote.

We select the correct runway

Seasonal income? We’ll structure payments that respect peaks and valleys. Early proposal payoff is available if a bonus, sale, or refinance appears.

Let’s put debt behind you

Want to understand what creditors may accept?

Share your numbers in confidence. We’ll map an offer that fits your cash flow and meets the

better-than-bankruptcy test.

We’ve got your back

Safeguards that protect you and ensure fairness in the process

If creditors initially reject your proposal

It’s rare for a Division I Proposal that’s built on fair numbers to be rejected. If creditors counter the first offer, we typically negotiate adjustments so the offer is still feasible for you, while appeasing the creditors. While the law says a debtor is immediately deemed bankrupt after a rejection, our approach is to design a Division I Proposal with a credible path to acceptance and to support you through any revisions needed.

If the court has questions

Court approval is routine when the proposal is reasonable and better than bankruptcy. If the court asks for clarification, it’s about fairness in the proposal process, not about you failing. The formal procedure is in place to ensure fairness for everyone.

If you fall behind on payments

Life happens. If you miss a scheduled Division I Proposal payment, call us early. Missing one payment doesn’t automatically end your proposal, you generally have 30 days (as set out in your proposal terms) to catch up. If you don’t, the proposal may be placed in default, and the court could consider deeming you bankrupt. Reaching out early helps us find practical solutions before it gets worse.

About your credit impact

A Division I Proposal will affect your credit rating, especially during the plan and shortly after. The upside is real: consistent, on-time payments create a track record lenders can see, and over time, your profile strengthens as you complete the proposal and are legally released from remaining eligible balances.

A conversation away

Relief begins with a single conversation

Big numbers, tight cash flow. Share the facts in confidence, and we’ll develop a plan you can stick to. Division I Proposal, or a simpler option if that fits better.

your licensed insolvency trustee

A partner you can trust

You deserve a steady hand. In Alberta, our Licensed Insolvency Trustees listen to you quietly without judgment. We listen, review your finances, and explain every option in plain language. If a Division I Proposal is suitable, we design it to protect what matters and earn creditor confidence.

We handle the difficult parts, including initial talks with creditors, the creditors’ meeting, documentation, and court approval so that you can focus on work and family. Because Division I involves additional paperwork and court procedures, we include an upfront payment in your plan, avoiding unexpected bills later.

Expect court approval, a few brief administrative steps afterward, the taxation of the final statement, and the LIT discharge. We will go over these milestones before filing so you always know what’s next and why. If a consumer proposal or another option is better for you, we will tell you. Our goal is debt relief you can trust.

why bna debt solutions?

When the numbers are big, we build a plan that works

We’ve been here a while

(27+ years)

This isn’t our first complex file. We’ve guided Albertans through every kind of individual and business filing under a Division 1 Proposal, so you’re not figuring this out alone.

Built around your life, not a template

Your cash flow, your timing, your goals. We shape a Division 1 Proposal (or corporate proposal, if that’s the fit) that your unsecured creditors can actually accept and you can actually follow.

Straight talk. Zero gimmicks.

You’ll get clear steps from a Licensed Insolvency Trustee, no scare tactics, no hidden fees. Just what’s happening, why it matters, and what comes next.

Relief now, stability later

Once it’s filed, collection calls start to ease, and wage garnishments pause. You get room to breathe as legal protection takes effect and a clear path to debt relief ahead.

Solutions over sales

If a consumer proposal makes more sense than a Division 1 Proposal, we’ll tell you. The point is the best solution, not the biggest pitch.

Licensed Insolvency Trustee – your financial referee.

Only an LIT can file Division 1 Proposals, Consumer Proposals, and bankruptcies under the Bankruptcy and Insolvency Act. We guide the process, ensure fairness between you and your creditors, and see your proposal through to court approval.

Ready for Breathing Room That Lasts?

Share your numbers in confidence

We’ll map a Division I Proposal or a simpler option that fits your life and earns creditor support, no pressure.

FREQUENTLY ASKED QUESTIONS

Your questions, answered – let’s clear things up

What’s covered and what isn’t in the Division 1 Proposal?

Included: Classic unsecured debts, such as credit cards, lines of credit, and payday loans. Also includes personal loans and most CRA income tax balances.

Talk to our trustees about directors’ liability and CRA debts if you plan to continue operating your business while filing a personal Division I Proposal.

Not included: Secured loans (stay current to keep your assets). Student loans can be included; however, if you haven’t been out of school for more than 7 years before starting the proposal, that debt will not be discharged, and you’ll need to continue payments after your proposal is completed. These loans will still receive dividends through your proposal, helping reduce the balance you’ll owe later.

Also typically not released: support payments, fines/penalties, and fraud-related debts.

Why the Division 1 Proposal Works?

Creditors seek a better return than what bankruptcy provides, and a Division 1 Proposal is a way to deliver it. Clients want feasible debt relief. A filed proposal offers both sides a process they can trust. When the process is followed and the terms are met, eligible balances are legally discharged.

How do we present your proposal to creditors?

We list your assets and the debts included and explain how the plan gives creditors a better return than a bankruptcy. We show what you owe, what you can pay, and how long the proposal lasts. We clarify the value in dollars and why it is fair.

What happens during the creditors’ meeting and voting process?

We present the proposal to unsecured creditors and hold a discussion period so that every creditor is heard. The vote is then tallied: if two-thirds in value (by dollars) and a majority in number accept, we move forward to the next step. If creditors need more information to consider their vote or provide a counter-offer, the initial meeting may be adjourned to a later date.

What happens after creditors approve your proposal?

With creditors on board, the Court reviews the record. Once judicial approval is granted, you gain further clarity: proposal payments continue, legal action remains paused, and the plan moves forward.

Is Counselling Required, Like In a Consumer Proposal?

No. Division 1 Proposals don’t require mandatory counselling sessions. We’ll still share tools and resources if you want them.

Our trustees

Protect what matters, keep operations moving

Our team has handled thousands of files across Alberta.

If you owe a significant amount, need debt relief without hassle, and want to pay a fair amount over time, now is the time to talk. Schedule a free consultation, share your financial situation, and we’ll explain how a Division I Proposal or other options can help you move from

pressure to a plan.