When tax season arrives, it’s not just about getting your income tax returns filed on time—it’s about staying on top of your tax obligations and avoiding falling behind. But what if you can’t pay your Canada Revenue Agency (CRA) taxes? The weight of unpaid tax debt can feel crushing, and that Notice of Assessment can make everything feel even more overwhelming.

If you’re worried about late payment penalties, a frozen bank account, wage garnishment, your credit score, or what the CRA might do next, it’s normal to feel trapped. We understand—it’s a difficult situation, but remember, you don’t have to face this alone. At BNA Debt Solutions, we’re here to help you navigate this challenging time. Let’s explore what you can do if you’re struggling with CRA tax payments.

1. Understanding the Consequences of Unpaid Taxes

Before we get into the solutions, it’s important to understand what happens with unpaid taxes. Ignoring the issue won’t make it disappear, and the longer you put it off, the harder it can be to fix. Addressing unpaid taxes early on can save you a lot of stress down the road.

Potential Penalties and Interest Charges

Unpaid taxes can add up quickly due to penalties and interest. The CRA charges a 5% late filing penalty on the unpaid balance, plus an additional 1% for each month it goes unpaid. On top of that, interest compounds daily, which means your debt can increase quickly. Additionally, interest compounds daily, which can increase the total amount owed over time.

The good news is that taking action, even in small steps, can help. Filing your tax return on time prevents extra penalties, and making even partial payments can slow interest accumulation and reduce your balance. Addressing it sooner rather than later can make managing your tax obligations much easier.

Potential Impact on Your Credit Score

Unpaid tax debts can hurt your credit score. When overdue taxes show up on your credit report, they can make it harder to get loans, mortgages, or new credit cards.

Creditors often see unpaid taxes as a higher risk when reviewing your finances. That’s why it’s important to address any outstanding tax debt to protect your creditworthiness. Setting up a payment plan or making regular monthly payments can help protect your credit score from further damage. Taking action now can make a big difference down the road.

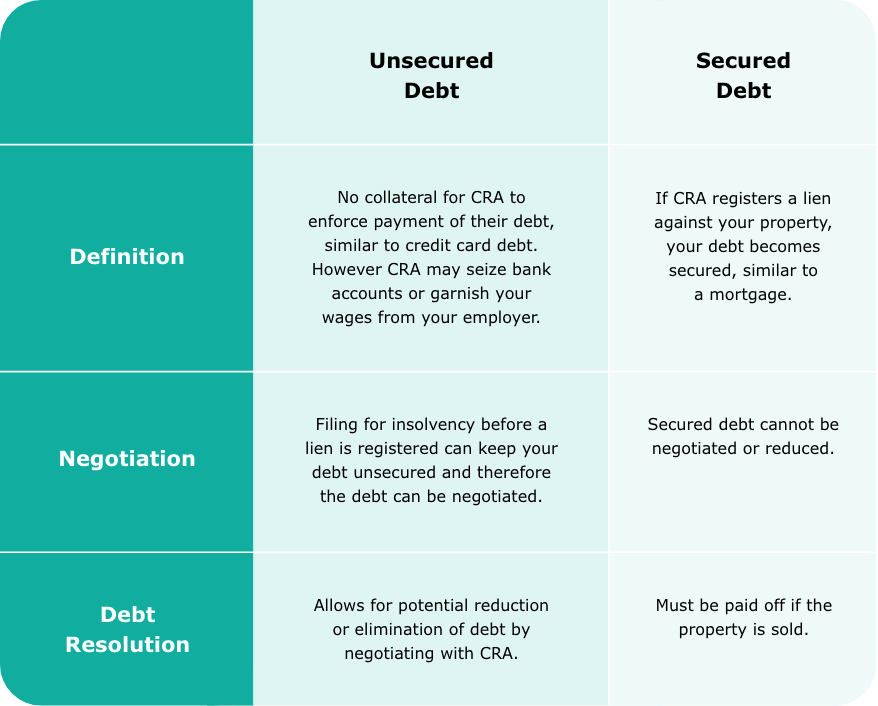

Lien Registration

If taxes go unpaid for too long, the CRA may file a lien against your property, turning your outstanding debt into secured debt. This means the CRA could claim your assets to cover what you owe. A lien can complicate matters if you plan to sell or refinance your property, as it must be resolved first. But Rest assured—if the CRA hasn’t registered a lien yet, there’s still time to take action. You’re not alone in this, and we’re here to help guide you through it.

2. File Your Tax Return on Time, Even if You Can’t Pay

One of the biggest mistakes you can make is not filing your taxes. Even if you can’t pay the taxes owed, filing on time is essential to avoid additional penalties.

Avoid Late-Filing Penalties

The CRA isn’t happy when returns go unfiled, and not filing on time means late-filing penalties that can add up fast, making things even harder. Filing on time helps you avoid these additional charges and shows the CRA you’re taking responsibility. It’s an important step in getting back on track, even if paying everything right away isn’t possible.

Start the Dialogue with CRA

Filing your return is the first step in fulfilling your tax obligations and opening communication with the CRA. Meeting this requirement demonstrates responsibility and can help you avoid further penalties. The CRA is more likely to work with individuals who take proactive steps by filing on time.

3. Contact CRA to Discuss Payment Options

Once your tax return is filed, it’s time to reach out to the CRA about how to handle the taxes owed. Many people don’t realize that the CRA is open to structured payment arrangements, especially if you’re facing financial difficulty. It’s worth starting the conversation—they may be more flexible than you think!

Negotiating a Payment Arrangement with CRA

The CRA understands that times can be tough, and they’re willing to work with you if you’re struggling with outstanding tax debt. They offer payment arrangements that allow you to pay off your taxes over time through monthly payments. However, to make this happen, they’ll need to evaluate your financial situation—considering factors such as your income, expenses, debts, and ability to pay before approving an arrangement.

Documents you may need: You’ll probably need to show proof of your income, outstanding debts, and any financial hardship you’re facing.

CRA’s assessment: Based on the information you provide, the CRA will determine the terms of your payment arrangement. Keeping everything organized can truly make a difference.

Requesting Taxpayer Relief or Forgiveness

Did you know that the CRA provides Taxpayer Relief Provisions to help reduce or even waive penalties and interest charges? If you’ve faced unexpected hardships such as a natural disaster, medical issues, or other tough situations, this relief could ease the burden of outstanding tax debt.

To apply, you’ll need to clearly explain why you couldn’t meet your tax obligations on time. Providing detailed documentation of the hardships affecting your finances will strengthen your case. The CRA carefully reviews these applications, so it’s important to ensure that all required information is complete and accurate. We’re here to guide you through the process.

4. Explore Payment Solutions for Immediate Relief

When it comes to unpaid taxes, quickly finding ways to manage the debt is essential. Two primary options include utilizing personal loans or credit lines, or contacting the Canada Revenue Agency (CRA) for short-term relief programs. Each option has its advantages and disadvantages.

Personal Loans or Credit Lines

Taking out a personal loan or opening a credit line can provide immediate cash to cover your tax obligations and help you avoid late payment penalties. However, keep in mind that these loans often come with high interest rates, and the repayment terms may affect your budget.

Other Short-Term Relief Options

If a loan isn’t the right fit, contact the CRA about alternative relief options. They may provide flexible payment arrangements, allowing you to pay off your outstanding balance over time and ease the financial strain. These plans can include monthly payments or setting up pre-authorized debits.

5. If CRA Denies Your Payment Plan, Explore Alternative Solutions

If the CRA denies your payment plan, don’t panic—there are still options. You might consider bankruptcy or a consumer proposal. Licensed Insolvency Trustees (LITs) play a crucial role—they are the only professionals who can help negotiate these reductions and guide you through the process.

Filing for Bankruptcy or a Consumer Proposal

If you owe a significant amount to the CRA and are struggling to keep up with payments, filing a consumer proposal may be a better alternative to bankruptcy. A proposal allows you to negotiate directly with CRA to reduce your debt and create a manageable repayment plan—without the long-term impact of bankruptcy or the legal fees associated with court proceedings.

However, if CRA is your largest creditor (holding 50% or more of your total debt), they will require all tax returns to be filed and assessed before they will vote on your proposal. This means that any outstanding tax filings must be completed before the proposal can move forward. If filings are incomplete, creditor meetings may be delayed for several months while CRA waits for an accurate assessment of what is owed.

At BNA Debt Solutions, we are well-versed in CRA debt-relief options, ensuring that your consumer proposal is properly structured and meets CRA’s requirements. Whether you’re exploring a consumer proposal or bankruptcy, our LITs will guide you through the process and help you determine the best path forward for your financial future.

High Tax Scenario

If your tax debt exceeds $200,000, and that makes up more than 75% of your unsecured debt, things can become more complicated. You may face delays in discharge from bankruptcy, and the Department of Justice (representing the CRA) might require more financial commitments.

In these cases, our Licensed Insolvency Trustees play a vital role in coordinating with the CRA and ensuring the best resolution for your situation. We’re here to guide you through it every step of the way.

6. Address CRA Liens Before It’s Too Late

If your CRA tax debt remains unpaid for too long, the CRA may register a lien against your property. This transforms your unsecured tax debt into secured debt, similar to a mortgage—and once that happens, a LIT can no longer negotiate or reduce it through a consumer proposal or bankruptcy.

Unsecured v. Secured Debt

What to Do if CRA Hasn’t Registered a Lien Yet?

If the CRA hasn’t registered a lien yet, now is the time to act. Acting quickly and reaching out to a LIT can help keep your tax debt unsecured, providing you with more options to reduce or compromise it. Addressing the situation early enables you to negotiate with the CRA before they take legal action, such as registering a lien.

At BNA Debt Solutions, we can help you explore options like a consumer proposal, which could allow you to negotiate a fair repayment plan and avoid the severe consequences of a lien. Don’t wait for things to get worse—contact us today to discuss your options and take the first step toward a fresh start. Your timely response is key to protecting your financial future.

How to Talk to CRA & Avoid Aggressive Collection Actions

Be Proactive with Timely Communication

It’s important to reach out to the CRA as soon as you realize you can’t meet your tax obligations. Contacting them early can help set up a manageable payment plan and prevent issues like liens or wage garnishments. The CRA is typically willing to work with you based on your financial situation, including options for monthly payments or partial payments.

Documenting Your Interactions with CRA

Keeping detailed records of your conversations with the CRA is crucial. Make note of dates, times, and the names of the representatives you speak with. Also, record the content and outcome of each conversation. This helps protect your interests and can be invaluable during future negotiations or if there are any discrepancies.

Implement Strategies for Future Financial Planning

Managing Tax Remittances as Self-Employed Individual

As a self-employed individual, managing your tax obligations can be challenging. Keeping up with your income tax returns and payments throughout the year is essential to prevent an outstanding balance during tax season. A good strategy is to set up monthly payments for GST, federal and provincial taxes.

By maintaining consistency, you can prevent accumulating an unpaid balance that may result in penalties, late fees, or even legal action from the CRA. This proactive strategy assists you in fulfilling your payment obligations and managing your tax liability effectively.

Switching from Self-Employed to a T4 Income

If managing tax remittances is becoming overwhelming and you’re struggling to keep up with tax payment deadlines, consider switching from self-employment to a T4 income. With a T4 job, income taxes are automatically deducted, putting the responsibility on your employer to remit your tax obligations, thus reducing the risk of unpaid taxes.

This shift can help prevent missed payments, ensuring compliance with the CRA and safeguarding your credit score. It’s a hassle-free way to manage your tax payments and steer clear of potential penalties. At BNA Debt Solutions, we’re here to help you explore the best options for your situation.

Staying Consistent with Tax Planning

Whether you’re self-employed or a salaried employee, it’s crucial to regularly review your finances and ensure you’re fulfilling your tax obligations. Establishing a budget that incorporates your tax payments is a proactive approach to prevent outstanding tax debt.

If you’re self-employed, set aside funds for taxes to prevent accumulating an unpaid balance that can grow during tax season. Tools like pre-authorized debits can make things easier, helping you stay up-to-date with your payment obligations. For salaried employees, ensuring your employer is staying on top of your tax deductions and payments is crucial to avoiding penalties and safeguarding your credit score.

How BNA Debt Solutions Can Help You Overcome Tax Debt

At BNA Debt Solutions, we are committed to providing reliable, personalized assistance for individuals facing tax debt challenges and other financial difficulties. Our focus is on delivering customized, respectful financial solutions that help our clients regain control of their finances and secure a more stable future.

Personalized Solutions for Tax Debt

We recognize that each tax situation is distinct. That’s why we provide consumer proposals as a practical alternative to bankruptcy. A proposal allows you to settle outstanding balances on your terms, spreading tax payments over time and lowering your tax liability. By managing unpaid taxes this way, we can assist in setting you up for success going forward, by reducing your stress and enabling you to file and pay your future taxes on time.

BNA’s Expertise in Negotiating with CRA

With over 27 years of experience, our team understands how to collaborate with the Canada Revenue Agency (CRA) to help reduce your outstanding tax debt through consumer proposals. These agreements can assist in managing late payment penalties and interest on unpaid balances. Our goal is to establish a manageable payment plan so you can concentrate on your financial recovery.

Frequently Asked Questions (FAQs)

How can I Manage my Tax Debt in Canada?

Managing tax debt in Canada typically involves setting up a CRA payment plan, seeking tax relief options, or filing a consumer proposal through a Licensed Insolvency Trustee (LIT) to negotiate and reduce what you owe. An LIT can help you explore the best solution for your situation.

Can I Consolidate my Debt in Canada?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How Can I Qualify for Government Tax Relief in Canada?

To qualify for government tax relief, you must demonstrate financial hardship and show your ability to pay. Government benefits such as refunds or lump-sum payments can be used to lower your tax debt. Consult a professional to explore all available options for tax relief.

What Are the Costs of Debt Management Services?

Debt management costs depend on your situation. Some services charge fees, but LITs provide free consultations to help you explore options like consumer proposals or structured repayment plans. Speaking with an LIT can give you a clearer understanding of your next steps.

What if I Can’t Make a Lump-sum Payment to the Government?

If you can’t make a lump-sum payment, the government provides options such as installment payments or tax relief. Collaborating with professionals can help establish payment amounts that align with your budget, minimizing the risk of losing assets.

Can CRA Freeze Your Bank Account?

Yes, the Canada Revenue Agency (CRA) has the legal authority to freeze your bank account if you do not pay your tax debt. This action is carried out through a Requirement to Pay (RTP), which enables the CRA to direct your financial institution to freeze and redirect funds toward your unpaid taxes.