Get in Touch: (403) 232-6220

Canadians are taking on higher levels of household debt to keep up with the rising cost of living. Two recent studies are quite revealing.

According to a 2023 report by TransUnion (one of Canada’s two credit reporting agencies), the average Canadian is now carrying a $4,000 credit card balance. That’s a 4.2% increase from the previous year.

On top of that, Statistics Canada reports that Canadians owe $1.85 on every dollar of disposable income. This includes credit, mortgage and non-mortgage-related loans.

The TransUnion report identified higher mortgage rates as the primary factor driving the increase.

As households spend more of their paycheques to cover mortgages, they are taking on higher credit card debt to cover other essential and discretionary spending costs: from groceries to travel.

The report notes that increased debt levels combined with higher interest rates mean that minimum credit card payments are now higher… making it even harder to pay off those credit card bills. (Interest rates rose 70% between Q1 2022 to Q1 2023).

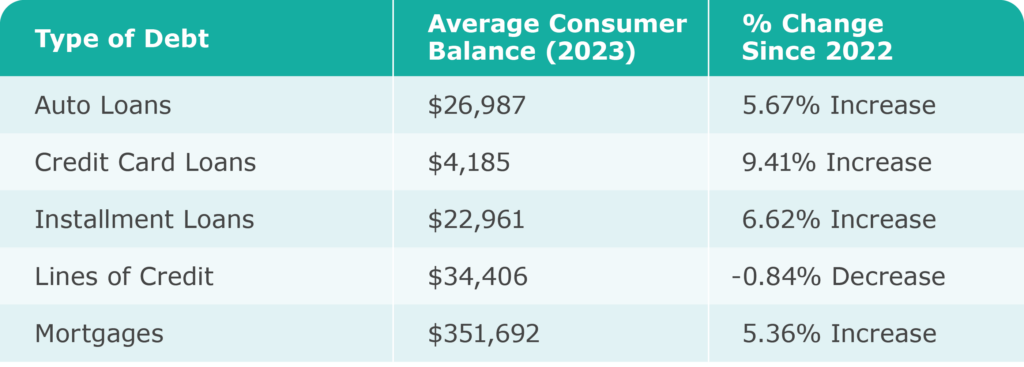

It’s not just mortgages and credit cards that account for rising debt levels. TransUnion says there is increased borrowing across the following categories:

TransUnion’s stats show that loan delinquency rates have grown by 8.01% across Canada. Interestingly, Alberta is bucking the trend, with a 5.8% decrease in loan defaults. This may be due to lower unemployment levels and higher salaries than the national average.

The fact that Canadians owe an additional 84¢ on every dollar of disposable income is alarming. As people take on more and more debt, the risk of default grows. At some point, paying debt becomes impossible – and the only way out is by seeking debt relief, declaring bankruptcy or filing a consumer proposal.

The TransUnion report reveals that the highest level of defaults is coming from Generation Z borrowers. The reason is not surprising.

Gen Zs (born between 1994 and 2010) are younger and at an earlier stage in their careers. Because they’re generally on entry-level salaries, they don’t have the same disposable income as Millennials.

As you can see, if you have debt, you’re certainly not alone. There may be months when your credit card balance hovers close to that national average. But this is one measure that you should aim to be well below.

The quicker you can pay off your credit card, the better off you’ll be. Those high interest rates add up as your balance grows.

The best way to look at mortgages is to determine if you can afford the monthly payments. In this time of uncertainty, economists recommend the predictability of a fixed-rate mortgage. This way, if interest rates go up, you’re not on the hook for higher payments.

Stick to a Budget: You don’t need to cut out everything you love, but it’s probably wise to cut back. Rising costs might mean reducing how much you spend on shopping, entertainment and dining out/ordering in. It could mean trying to get another year or two out of your vehicle and putting off the purchase of big-ticket items (like a new TV, fitness station or sofa).

Don’t Just Make Minimum Monthly Payments: The more money you can put towards your credit card payments, the quicker that debt will go away. If you’re just repaying the minimum, your debt will continue to rise.

Seek Debt Counselling Sooner than Later: If loans and credit card debt keep adding up faster than your ability to pay, find someone who can help. We recommend getting guidance from a trained and licensed provider. Options such as a Consumer Proposal allow you to negotiate with creditors (through a Licensed Insolvency Trustee) and can be preferable to bankruptcy.

We get it. Fear of missing out is real! You don’t want to be left out as your friends enjoy vacations and big nights out. But with a little discipline, you can strike a balance that lets you enjoy life without getting into debt trouble.