Answering questions about Consumer Proposals.

At BNA, we completely understand the difficulties and anxieties that come with being in debt. Worrying about the future is something many of us share

At BNA, we completely understand the difficulties and anxieties that come with being in debt. Worrying about the future is something many of us share

As Licensed Insolvency Trustees, the team here at BNA Debt Solutions have spent the last 25 years revitalizing Albertans by eliminating or significantly reducing debts.

Tax time is upon us, and our team of insolvency professionals at BNA Debt Solutions is gearing up for yet another busy season of helping

The Canada Emergency Response Benefit, otherwise known as CERB, has proved to be a lifeline to millions of Canadians over the COVID crisis. To maximize

Why Choose BNA Debt Solutions? With a variety of options out there to help you solve your debts, why choose BNA Debt Solutions is an

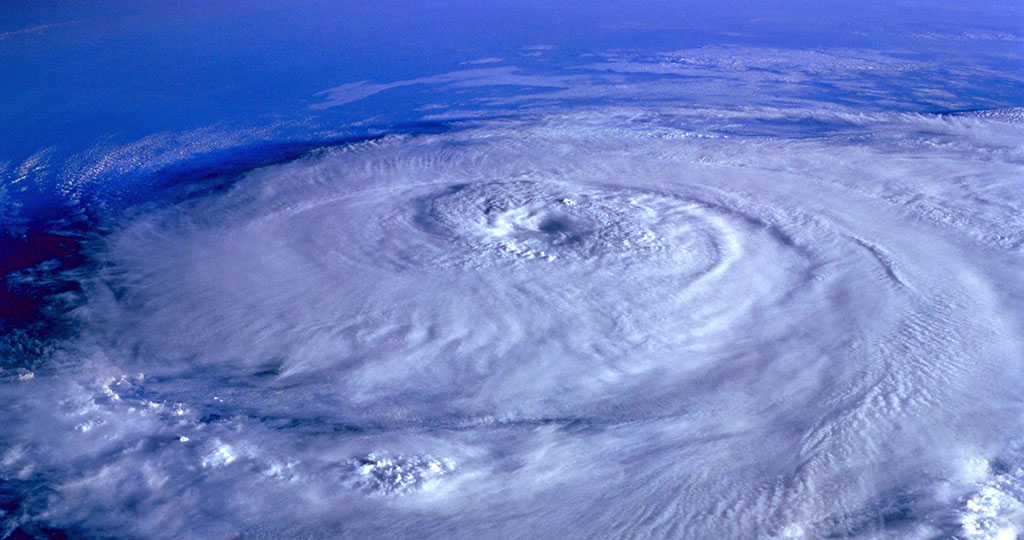

COVID-19, the very word inflicts a sea of emotions and thoughts in our minds, the impact of the COVID pandemic has affected each of us

The economic impact of COVID-19 has us answering a lot of questions about consumer proposals. The pandemic has impacted every person, every family in one

Insolvency filings have dropped to a record low in Canada, but you shouldn’t be surprised. According to a recent Scotiabank survey, filings in April dropped

“You can’t borrow yourself out of debt.” It’s a common phrase around the BNA Debt Solutions office, and for a good reason. Through our work

We’ve all had time to try and adjust to our new, temporary lifestyles under the COVID-19 lockdown. Even with restrictions lifting in the coming weeks,