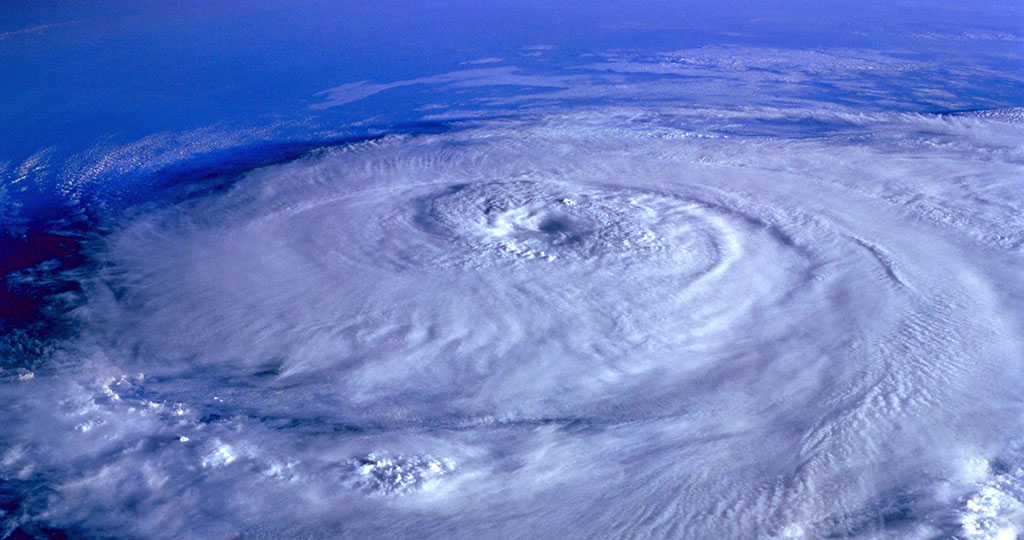

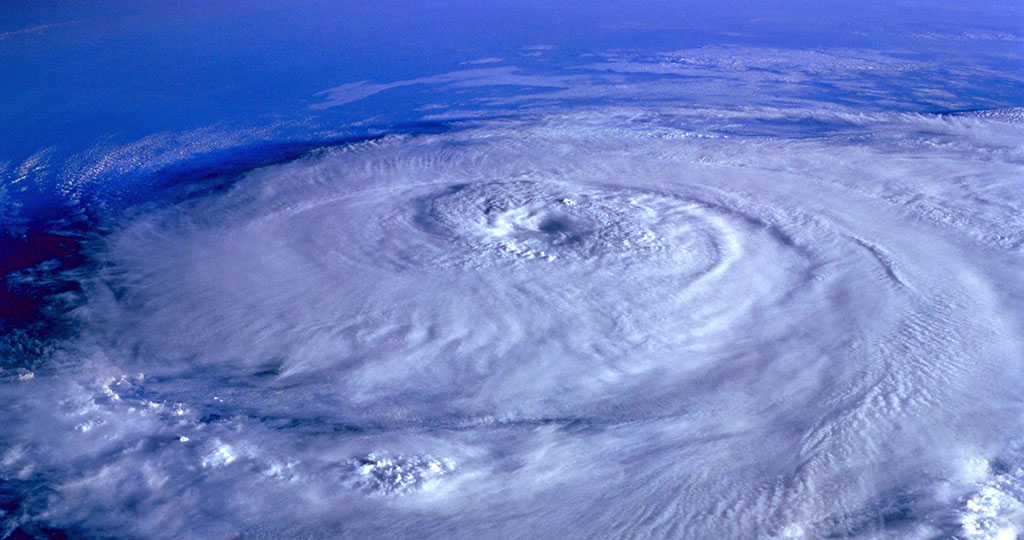

The Storm is Coming. We Can Help.

Insolvency filings have dropped to a record low in Canada, but you shouldn’t be surprised. According to a recent Scotiabank survey, filings in April dropped

Insolvency filings have dropped to a record low in Canada, but you shouldn’t be surprised. According to a recent Scotiabank survey, filings in April dropped

“You can’t borrow yourself out of debt.” It’s a common phrase around the BNA Debt Solutions office, and for a good reason. Through our work

We’ve all had time to try and adjust to our new, temporary lifestyles under the COVID-19 lockdown. Even with restrictions lifting in the coming weeks,

It is needless to say that we are living in unprecedented times. The COVID-19 crisis is affecting almost every aspect of our lives, and our

When we think of the approach of spring, we often think of new beginnings, of the promise of warmer weather, green grass and blooming flowers.

We’ve been in the insolvency business for over 20 years. In that time, we’ve helped over 10,000 Albertans eliminate their debt. If there’s one common

NOTE TO CLIENTS: Due to the recent series of events regarding COVID 19, we are following the recommendations of our public health and government officials.

Canadians are filing personal insolvencies at the highest rate in over a decade. According to the latest figures from the Office of the Superintendent of

The holiday season is a great time of year. It’s a time of hope, celebration and peace that we get to spend with our closest

No one sets out with the intention to take on a serious debt load, and no one certainly ever plans on insolvency. However, life happens,