Get in Touch: (403) 232-6220

Those struggling to address debt challenges in Alberta have yet one more thing to worry about.

A growing number of Albertans are falling prey to unscrupulous businesses that are not authorized to provide the services they claim. It’s a problem that is costing victims thousands of dollars – and making an already difficult situation worse.

They are taking advantage of the victims in a way that is unethical and deceptive… but not clearly illegal. Their tactics carefully tiptoe around the murky edges of the law.

Victims are tricked into paying thousands of dollars upfront – without getting the services promised. This includes promises to file for bankruptcy or negotiate with creditors to reduce debt repayment (often with deceptive promises of saving huge amounts of money).

After taking your money, the person simply refers the victim to the person they should have spoken to in the first place.

According to Melanie Goulet, a Licensed Insolvency Trustee at BNA Debt Solutions, “All they do is take your money and put you in touch with a Trustee.

“The poor victim is tricked into paying thousands to someone who isn’t helping one bit.”

Here’s What You Need to Know

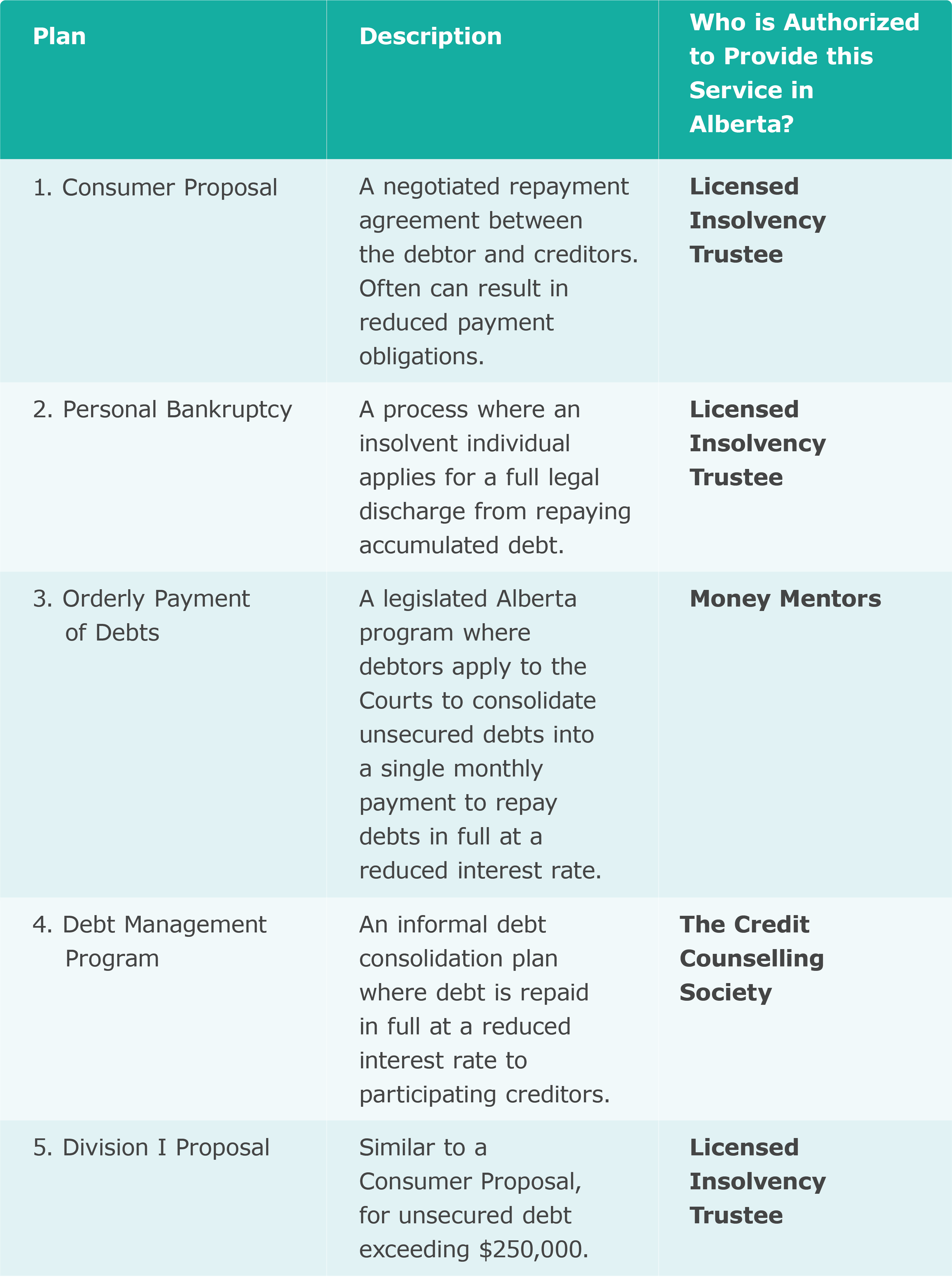

There are five debt relief plans available in Alberta. Only designated organizations or certified professionals are authorized to manage these programs on behalf of Albertans.

“You can’t just do it yourself. And the law clearly says who can help,” Goulet says, adding that not even lawyers can provide these services.

Learn more about choosing the right debt repayment plan in Alberta.

Two of the most common programs are Consumer Proposals and Personal Bankruptcy. In Canada, these programs can only be managed by regulated, certified professionals called Licensed Insolvency Trustees (LIT).

Goulet says Licensed Insolvency Trustees will have assistants (often known as ‘Administrators’) who may do initial screening and information gathering on behalf of the LIT.

She stresses that Licensed Insolvency Trustees and their staff rarely charge an upfront fee for this work. There may be some exceptions.

This is where these questionable ‘advisors’ insert themselves into the process… without adding any value. Some may hint that they can do the work of a LIT without directly saying so.

“All they do is take your money and put you in touch with a real trustee.”

“They don’t actually work for an LIT. But they will say they can help. They will arrange to collect information and do the ‘upfront’ interview. They’ll charge for this ‘service’ and demand payment up front.”

Goulet adds that in some cases, they may offer shady services such as in-depth debt counseling or bogus services such as Proposal Insurance.

Once someone has paid, they won’t be able to recover these fees. And in most cases, the provider won’t deliver the services they promised.

According to Goulet, these companies are very cautious with their language. “It’s incredibly tricky and misleading, but they never actually say anything that could get them prosecuted.”

Tip: In Alberta, a debt advisor, administrator, or counselor dealing with a bankruptcy or consumer proposal MUST be registered under a LIT’s license to provide the required counseling.

Because they are technically not doing anything illegal, these businesses will work right out in the open. They often have offices, websites and slick social media ads. Goulet says many even set up booths in shopping malls. This makes them seem legitimate.

According to BNA’s Melanie Goulet, one of the challenges is that these companies get people to sign contracts that legally require those who sign to pay for the services they offer… even if they aren’t truly helpful.

As a Licensed Insolvency Trustee who is frustrated with seeing vulnerable Albertans fall for these scams, Melanie Goulet shares the following advice for those looking for someone to help with a Consumer Proposal or Bankruptcy:

Short Answer Legally you must owe at least $1,000.00 meets the qualification for a consumer proposal but practically, we would never let anyone file a

Short Answer You can apply for credit while in a consumer proposal but probably won’t be approved unless it is secured by a prepaid balance.

Short Answer Legally there is nothing that would not allow you to buy a house while in a consumer proposal, however you may have difficulty